Mastering Marketing Compliance with PerformLine’s Expert Guidance

From web content, social media, and email marketing to call centers, messages, and physical collateral, marketing compliance applies to all mediums. And for highly regulated industries like banks, financial institutions, banking-as-a-service (BaaS), mortgage lenders and servicers, credit card issuers, and buy now pay later organizations, strict compliance is especially critical.

Table of Contents

But, marketing compliance is more than just following rules and regulations. It’s about protecting your brand’s reputation and consumer trust through traceable oversight of your marketing efforts.

Neglecting compliance can be disastrous to any business, and managing compliance obligations can be complex and time-consuming. That’s why marketing compliance software has become increasingly popular to streamline processes, reduce risk, and improve overall team performance.

In this article, we’ll explore everything you need to know about marketing compliance for highly regulated industries and how neglecting compliance can be disastrous. We’ll cover everything from the regulations that govern marketing compliance to implementing a marketing compliance management system and provide tips for ensuring compliance across all channels.

What is marketing compliance?

In a simple definition, marketing compliance means adhering to the regulations and guidelines set by government agencies to ensure that your company’s marketing, advertising, and sales content is truthful, transparent, and doesn’t mislead consumers.

Whether you’re posting something online, sending an email, chatting with customers on the phone or through messaging, or even sending out physical mailers, it’s important to make sure everything you say follows the rules. Your company is responsible for making sure all of your messaging is consistent and in compliance with those rules.

📋

Follow these 10 steps to ensure your marketing campaigns are compliant from the start.

The importance of marketing compliance

In today’s world where information spreads like wildfire, it’s more important than ever for consumer finance companies to prioritize marketing compliance. Not only does it protect your business from enforcement actions and hefty monetary fines, but it also safeguards your brand’s reputation.

Imagine this: your company unknowingly publishes marketing content that violates regulations and consumer protection laws. Suddenly, you’re facing an enforcement action from a government agency, and your business is in the spotlight for all the wrong reasons.

⚖️

Stay updated with the latest enforcement actions and how they impact marketing compliance.

Your reputation is at risk of being tarnished, and the public’s trust in your company could plummet. In today’s digital world, where news travels fast and bad news even faster, the negative effects could be devastating.

But, more importantly, compliance isn’t just about protecting your business—it’s also about protecting consumers.

By following regulations, you’re ensuring that the content you’re putting out is accurate, transparent, and not misleading. You’re providing consumers with the information they need to make informed decisions about their financial products and services. In turn, you’re building trust and loyalty, which can lead to increased customer retention and acquisition.

Consumer finance companies have a responsibility to put their customers’ interests first. By prioritizing marketing compliance, you can build a strong reputation and protect both your customers and your business while mitigating risk and avoiding enforcement actions.

Who oversees marketing compliance for consumer finance?

There are a number of regulatory agencies that oversee consumer finance organizations for marketing compliance, including:

- Consumer Financial Protection Bureau (CFPB): The CFPB is responsible for enforcing federal consumer protection laws, including those related to marketing and advertising practices of consumer financial products and services. They also have the authority to investigate consumer complaints related to marketing and advertising.

- Federal Trade Commission (FTC): The FTC is responsible for enforcing federal consumer protection laws related to unfair or deceptive marketing practices. They have the authority to investigate and take legal action against companies that engage in deceptive marketing practices.

- Federal Communications Commission (FCC): The FCC regulates the marketing and advertising practices of telecommunications companies, including those related to telemarketing, email marketing, and text message marketing. They enforce laws related to the use of auto-dialers, caller ID spoofing, and other marketing practices.

- U.S. Securities and Exchange Commission (SEC): The SEC oversees the marketing and advertising practices of investment companies and investment advisors. They have the authority to investigate and take legal action against companies that make false or misleading statements in their marketing materials.

- Financial Industry Regulatory Authority (FINRA): FINRA is responsible for overseeing the marketing and advertising practices of securities firms and brokers. They enforce rules related to the use of customer testimonials, performance claims, and other marketing practices.

- Office of the Comptroller of the Currency (OCC): The OCC is responsible for supervising national banks and federal savings associations, including their marketing and advertising practices. They enforce regulations related to the use of misleading or false advertising and other marketing practices.

- State Attorneys General: State Attorneys General have the authority to investigate and take legal action against companies that engage in deceptive marketing practices. They also have the authority to enforce state-specific consumer protection laws related to marketing and advertising.

✅

Ensure your marketing efforts are compliant with our comprehensive UDAAP checklist tailored for the consumer finance industry.

Key marketing compliance regulations

When it comes to the financial services industry, there are an endless number of regulations, requirements, guidelines, acts, industry standards, and more set forth to protect consumers. While the complete list of legislation is extensive, and many laws are unique to certain industries, there are a few important acts and regulations to be aware of.

Dodd-Frank Act (Dodd-Frank Wall Street Reform and Consumer Protection Act)

In response to the 2008 financial crisis, The Dodd-Frank Act aims to promote financial stability and protect consumers by implementing a wide range of reforms to the financial system. It established new regulations for banks, mortgage lenders, and other financial institutions, and created new government agencies to oversee the financial industry, including the CFPB.

Unfair, Deceptive or Abusive Acts or Practices (UDAAP)

Under Dodd-Frank, UDAAP (or unfair, deceptive or abusive acts or practices) by those who offer financial products and services to customers are illegal. This is also covered under Section 5 of the Federal Trade Commission Act (where it is referred to as UDAP, or Unfair or Deceptive Acts or Practices).

🔍

Discover the most common UDAAP compliance issues found in marketing content and how to address them.

Its purpose is to ensure that consumers have access to the information they need to choose the best product or service for their situations and needs. In practice, defining UDAAP can be a bit tricky. Check out this article that highlights the 4 most common UDAAP marketing compliance violations and how to avoid them.

Federal Trade Commission Act

The Federal Trade Commission Act is a part of UDAAP. The Act prohibits businesses from engaging in unfair or deceptive acts or practices that affect commerce, and gives the FTC the power to enforce this prohibition.

Under the FTC Act, the FTC has the authority to investigate and take legal action against companies that engage in unfair or deceptive practices, such as false advertising, price fixing, and deceptive sales practices. The FTC can issue cease and desist orders, impose fines, and require companies to run corrective advertising.

Truth in Lending Act (TILA)

The Truth in Lending Act requires lenders to disclose certain information about a loan or credit transaction to the borrower before the borrower becomes obligated to repay the loan. The purpose of TILA is to promote the informed use of consumer credit by requiring lenders to provide consumers with accurate and timely disclosures about the terms and costs of their loans or credit transactions.

These disclosures must include information such as the annual percentage rate (APR), finance charges, total amount financed, payment schedule, and any fees or penalties that may apply. TILA also gives consumers the right to cancel certain types of credit transactions within a specific period of time.

Credit Card Accountability, Responsibility and Disclosure Act (CARD Act)

The CARD Act is an amendment to the Truth in Lending Act (TILA) “to establish fair and transparent practices relating to the extension of credit under an open-end consumer credit plan, and for other purposes.”

Essentially, the CARD Act is aimed to reduce unexpected fees for credit cards and improve the disclosure of costs and penalties.

Truth in Advertising Act

The Truth in Advertising Act is a federal law in the United States that aims to prevent false or misleading advertising practices in commerce. The Act prohibits advertisers from making false or deceptive claims about their products or services, and requires them to back up their claims with evidence.

The Act applies to all forms of advertising, including print, television, radio, and online advertising. It also covers endorsements and testimonials, and requires advertisers to disclose any material connections they have with endorsers or reviewers.

Telephone Consumer Protection Act (TCPA)

The Telephone Consumer Protection Act was created to stop unwanted telemarketing calls to consumers by telemarketers, banks, debt collectors, and others through the use of autodialers or robocalls. TCPA limits the use of automatic dialing systems, pre-recorded messages, text messages, and fax machines.

An update in 2012 to TCPA by the FCC established the following requirements and conditions for telemarketers:

- To obtain prior express written consent from consumers before robocalling them

- Telemarketers can no longer use an “established business relationship” to avoid getting consent from consumers

- Telemarketers must provide an automated, interactive “opt-out” mechanism during each robocall so consumers can immediately tell the telemarketer to stop calling.

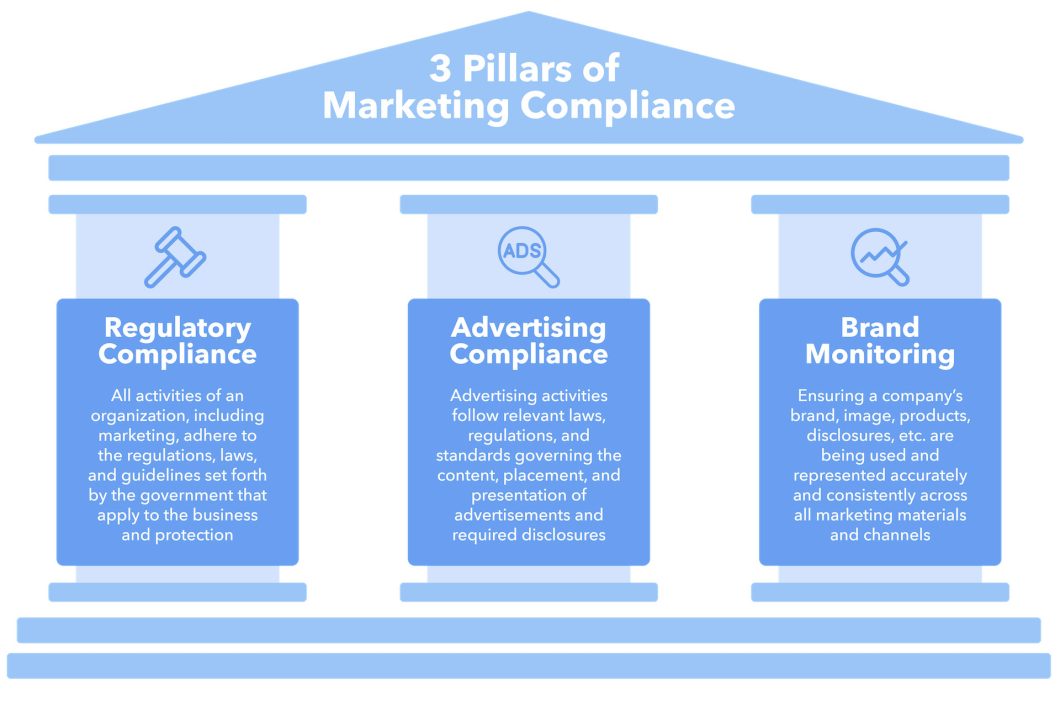

3 pillars of marketing compliance

There are three key areas of marketing compliance that every consumer finance company should focus on—regulatory compliance, advertising compliance, and brand monitoring.

Regulatory Compliance

Regulatory compliance means ensuring that all activities of an organization, including marketing, adhere to the regulations, laws, and guidelines set forth by the government that apply to the business and consumer protection. It’s essential to ensure that your marketing materials are aligned with your organization’s overall regulatory compliance requirements.

This pillar of marketing compliance is crucial for protecting your business from legal action and fines. These regulations are constantly changing, so it’s essential to stay up-to-date and compliant with any new regulations or updates.

It’s also important to note that there are specific regulations for different types of financial products and services. Make sure you’re informed on which regulations apply to your business.

Advertising Compliance

Advertising compliance specifically focuses on ensuring that advertising activities follow relevant laws, regulations, and standards governing the content, placement, and presentation of advertisements and required disclosures, as well as the claims that advertisers can make about their products or services.

By adhering to advertising compliance regulations, you’re ensuring that your advertisements are truthful, not misleading, and don’t harm consumers. Failure to comply with these regulations can result in legal action and harm to your brand’s reputation.

Brand Monitoring

Brand monitoring is a crucial aspect of marketing compliance that ensures a company’s brand, image, products, disclosures, etc. are being used and represented accurately and consistently across all marketing materials and channels. It helps organizations find any instances of misuse of their brand across the web and social media by known partners or unknown entities so that they can be swiftly remediated to avoid any potential compliance issues or regulatory scrutiny.

How marketing compliance impacts your role

In a consumer finance organization, several departments and roles are responsible for marketing compliance, including compliance, legal, marketing, and sales.

Here’s a breakdown of the common titles and roles and how they impact marketing compliance.

Chief Compliance Officer: Leadership and Governance

As the Chief Compliance Officer, your role involves providing leadership and governance for the compliance program, overseeing that program, and ensuring that it aligns with the organization’s strategic goals and objectives.

If this is your role, you’re responsible for creating a culture of compliance throughout the organization. You work closely with other senior leaders to ensure that compliance is integrated into all aspects of the organization’s operations.

Your responsibilities might include:

- Developing and implementing the compliance program for all marketing channels

- Providing strategic guidance and leadership for the compliance program

- Ensuring that compliance is integrated into all aspects of the organization’s operations

- Monitoring and reporting on compliance risks and issues to senior management and the board of directors

- Ensuring that the organization is in compliance with relevant laws, regulations, and industry standards

Compliance Officer: Strategic Oversight

As a Compliance Officer, your role involves overseeing the entire compliance program for your organization. You’re responsible for developing and implementing compliance policies, procedures, and controls to ensure that your organization complies with all relevant regulations and industry standards.

If this is your role, you have a broad view of the compliance landscape for all marketing channels, including the web, social media, email marketing, messages, call centers, and content approvals. You’re responsible for ensuring that all marketing activities comply with regulatory requirements and that your organization has the necessary controls in place to mitigate compliance risks.

Your responsibilities might include:

- Developing compliance policies and procedures for all marketing channels

- Conducting regular compliance risk assessments and audits to identify and mitigate compliance risks

- Providing compliance training and education to all employees involved in marketing activities

- Monitoring and enforcing compliance with regulatory requirements and internal policies

- Working with other departments, such as Legal, Marketing, and IT, to ensure that compliance is integrated into all aspects of the organization’s operations

Legal Counsel: Legal Compliance

As Legal Counsel, your role involves providing legal advice and guidance on marketing compliance issues. You’re responsible for ensuring that all marketing activities comply with relevant laws and regulations, including consumer protection laws, privacy laws, and advertising standards.

If this is your role, you’re involved in reviewing marketing materials and campaigns to ensure that they comply with legal requirements. You work closely with the marketing team to provide legal advice on marketing strategies and initiatives.

Your responsibilities might include:

- Reviewing marketing materials and campaigns to ensure compliance with relevant laws and regulations

- Providing legal advice on marketing strategies and initiatives

- Drafting and negotiating contracts with marketing vendors and agencies

- Conducting legal research on marketing compliance issues

- Representing the organization in legal proceedings related to marketing compliance

Director of Compliance: Implementation and Execution

As the Director of Compliance, your role involves implementing and executing the compliance program for all marketing channels. You’re responsible for ensuring that all marketing activities comply with regulatory requirements and internal policies.

If this is your role, you work closely with other departments, such as Marketing, Legal, and IT, to ensure that compliance is integrated into all marketing activities. You’re responsible for implementing and monitoring controls to mitigate compliance risks.

Your responsibilities might include:

- Implementing and executing the compliance program for all marketing channels

- Working with other departments to ensure that compliance is integrated into all marketing activities

- Developing and implementing compliance controls to mitigate compliance risks

- Conducting compliance training and education for all employees involved in marketing activities

- Monitoring and reporting on compliance risks and issues to senior management and the Chief Compliance Officer

VP of Marketing or Chief Marketing Officer: Strategic Oversight

As the VP of Marketing or Chief Marketing Officer, your role has a crucial impact on ensuring compliance across all marketing channels. You’re responsible for the overall marketing strategy and, therefore, ensuring that your team is meeting brand standards and regulatory requirements.

Some key marketing compliance responsibilities that fall under your purview include:

- Setting the compliance strategy and guidelines for all marketing activities

- Ensuring that all marketing campaigns and materials are compliant with industry regulations and laws, such as the CAN-SPAM Act and FTC guidelines

- Reviewing and approving all marketing materials, including web content, social media posts, emails, and other marketing collateral

- Training your team members on compliance best practices and keeping them up to date with changes in the regulatory landscape

- Working with legal and compliance teams to address any compliance issues that arise

Given the scope of your role, it’s crucial to have the right tools and processes in place to streamline compliance oversight and ensure that your team is staying on top of compliance requirements.

Content Marketer: Tactical Control

As a content marketer, your role involves creating and managing content for various marketing channels. From developing blog posts and articles to producing videos and podcasts, your work impacts various customer journey stages.

You play a critical role in ensuring that all content meets brand standards and regulatory requirements, including:

- Ensuring that all content includes the required disclaimers, disclosures, and other regulatory language

- Working with legal and compliance teams to ensure that all content meets relevant industry regulations and laws

- Reviewing and approving content before publishing, and making sure that any necessary changes are implemented in a timely manner

- Maintaining a digital trail of all content changes and approvals, and ensuring that all final versions are saved and stored in an acceptable format and location

Without proper processes in place, managing compliance across all your content can be a challenging and time-consuming task. Automated oversight, audit trails, and controlled content reviews can help to alleviate some of the compliance burden and free up more time for creating engaging and effective content.

Social Media Manager: Operational Control

As a social media manager, you’re responsible for creating, scheduling, and posting content across various social media channels. Your role involves maintaining the brand voice and tone across all social media platforms while also adhering to regulatory guidelines and requirements.

Some of the key marketing compliance responsibilities that fall under your purview include:

- Ensuring that all social media content includes the necessary disclaimers, disclosures, and other regulatory language

- Monitoring social media conversations for compliance issues and addressing any issues that arise promptly

- Working with legal and compliance teams to ensure that all social media content meets relevant industry regulations and laws

- Maintaining a digital trail of all social media content changes and approvals, and ensuring that all final versions are saved and stored in an acceptable format and location

With the constant stream of social media activity, it can be challenging to keep up with compliance requirements without proper tools and processes in place. Automated compliance monitoring and oversight can help you to stay on top of compliance issues and ensure that all social media content is compliant.

Email Marketing Manager: Tactical Control

As an email marketing manager, you’re responsible for creating and managing email campaigns that engage and convert leads into customers. Your role involves maintaining a clean email list and ensuring that all emails comply with regulatory requirements and industry best practices.

Some key marketing compliance responsibilities that fall under your purview include:

- Ensuring that all emails include the necessary disclaimers, disclosures, and other regulatory language

- Ensuring that all emails comply with the CAN-SPAM Act and other relevant industry regulations and laws

- Reviewing and approving email content before sending, and making sure that any necessary changes are implemented in a timely manner

- Maintaining a digital trail of all email changes and approvals, and ensuring that all final versions are saved and stored in

VP of Sales: Driving Revenue and Compliance

As a VP of Sales, you are responsible for driving revenue growth for your company while ensuring that your team operates in a compliant manner.

Some of your key marketing compliance responsibilities may include:

- Overseeing sales and business development activities, including introductions, demos, calls to target companies, and closing new business

- Managing a sales organization that must meet revenue goals while also complying with regulatory requirements

- Staying up-to-date on industry trends to stay ahead of competitors and make sure your sales team is equipped to handle the latest developments

- Moving quickly and efficiently in building and onboarding partnerships and affiliates that meet regulatory requirements

- Balancing revenue growth with compliance requirements, such as staying within regulatory boundaries while closing deals

- Working closely with legal and compliance teams to ensure that your sales team is following compliance standards and to stay informed of any regulatory changes

- Developing strategies that balance revenue growth with compliance requirements to ensure that your team is successful in achieving its goals

The challenges of marketing compliance

Marketing compliance poses several challenges to consumer finance companies.

Content approval processes and bottlenecks

Typically, the compliance and legal teams are responsible for reviewing and approving marketing content to ensure that it follows regulatory standards and guidelines. Since these teams have responsibilities outside of marketing content approval, they can easily get overwhelmed and backed up with their workload, especially if the marketing team works fast and creates a lot of content.

Because of this, the content approval processes can be time-consuming and inefficient, leading to bottlenecks that slow down marketing initiatives.

Comprehensive oversight

According to a study by PerformLine, comprehensive oversight was the top marketing compliance challenge faced by organizations today.

With so many different marketing channels and third-party partners to manage, it can be tough to stay on top of everything. They not only have to monitor their own internal marketing materials but also those of their partners and third parties.

Ever-changing regulations

Ever-changing regulations can be a major challenge for companies when it comes to marketing compliance—keeping up with regulatory change was the second most common marketing challenge for organizations.

The regulatory landscape is constantly shifting and evolving, which means that it can be difficult for businesses to keep up with the latest changes and ensure that their marketing materials remain compliant. This challenge is further compounded by the fact that different jurisdictions may have their own regulations and requirements.

Bandwidth restrictions

Managing marketing compliance efforts can be a difficult task for consumer finance companies of all sizes. With an ever-growing number of regulations to comply with, and an increasing volume of marketing content to monitor, bandwidth can become a major challenge.

In a recent survey by PerformLine, bandwidth was reported to be the third most common marketing compliance challenge.

Similarly, almost three-quarters of organizations (74%) reported having a small compliance team of 5 or fewer. Even for large enterprises, only 33% reported having a larger team of 6 or more.

Budgets

Marketing compliance can be a significant investment, particularly for consumer finance companies.

They need to balance the expense of compliance with other marketing priorities, and one of the challenges they face is budget constraints.

For instance, it can be expensive to hire additional compliance staff to manage the workload, particularly given the constantly evolving regulatory landscape.

Budgetary constraints continue to pose an increasing challenge for marketing compliance. From 2022 to 2023, the number of compliance professionals reporting budget as a top challenge increased by 111%.

Unknown brand mentions and placements

The internet can feel like the wild wild west, and thousands of third-party websites could be using a brand’s name, logo, or content without their knowledge or permission. Or, even worse, they could be using them in a deceptive, non-compliant way, which could lead to much larger issues.

Finding all of these mentions across the web is impossible to do with manual review. A compliance team could spend hours upon hours searching for sites that mention their brand, but they’ll never be able to find them all.

Bad actors

Not all partners and third parties are created equal. While most have a brand’s best interest in mind, some do not and could be using a brand’s name and logo for deceptive practices, or could be failing to adhere to regulatory and brand guidelines.

Increased partnerships

As financial institutions continue to partner with fintech companies and other third-party vendors, the volume of marketing content they’re responsible for monitoring and ensuring compliance with regulations can increase exponentially.

With more partners, there are more channels and types of marketing materials to oversee, making it challenging to maintain consistent compliance.

For example, banks partnering with fintech companies may need to ensure compliance not just with their own regulations, but also with those that apply to their partners’ activities.

Regulatory expertise

Navigating regulations in the consumer finance industry can be incredibly challenging, especially since there are so many different regulations to keep track of.

Each product and service offered may have its own set of unique regulations, making it even more complicated. It’s no wonder that it’s difficult for individuals to keep up with all the changes and nuances, even more so for organizations that offer multiple products and services.

Ensuring marketing compliance during the entire content creation process

Ensuring marketing compliance throughout the entire content creation process is crucial for businesses operating in highly regulated industries—it’s not enough to just review and approve content before it’s published, but content should be monitored post-publication to ensure that it remains in compliance and hasn’t been altered.

The importance of marketing compliance monitoring after content is published cannot be overstated. Even with a pre-approval process in place, there’s always a risk of content being changed or updated after the initial approval.

This is where marketing compliance monitoring comes in, as it provides real-time oversight and enables businesses to identify any non-compliant changes as soon as they occur.

For example, a change to an advertisement that seems minor could unintentionally mislead consumers or violate UDAAP regulations, resulting in significant consequences for a business if not identified and remediated promptly.

Automated marketing compliance platforms, like PerformLine’s omni-channel compliance platform, can help streamline the compliance review and approval process for marketing materials before they’re published, and can automate and scale the ongoing compliance monitoring of content once it’s live.

By automating compliance reviews and monitoring, businesses can increase speed and efficiency, reduce human error, encourage structure through a single platform, and have a complete audit trail to demonstrate good faith efforts to comply with regulations.

Channels you should be monitoring for marketing compliance

Compliance efforts can’t stop at just one or two channels. In today’s digital age, consumers are engaging with brands across a variety of channels, from social media to email to call centers. And with each of these channels come unique compliance challenges and regulations that must be adhered to. Consumer protection is paramount, and maintaining compliance across all marketing channels is essential in meeting that objective.

Across the Web

The internet has revolutionized the world of marketing and has made it easy to reach customers from every corner of the world. However, it’s also brought with it many challenges in ensuring marketing compliance.

One of the biggest challenges in ensuring compliance across the web is keeping up with the constantly changing landscape of online advertising. With new platforms and technologies emerging all the time, it can be difficult to stay on top of the latest trends and regulations.

Another key element of compliance is website content. All content on your website (and on your partners’) needs to be accurate, truthful, and not misleading in any way. This includes product descriptions, customer reviews, and any other information that may be published on your site or on behalf of your brand.

You should be monitoring your marketing content and brand across the web to catch potential marketing compliance issues (from known and unknown placements) so that you can proactively avoid risk and protect consumers.

Email Marketing

Email marketing is a powerful tool for businesses to connect with their customers and promote their products and services. By sending targeted and personalized emails, businesses can increase brand awareness, drive traffic to their website, and boost sales. However, as with any marketing channel, email marketing also poses several compliance risks that businesses must be aware of.

One of the biggest compliance risks associated with email marketing is the risk of violating the CAN-SPAM Act. This federal law requires businesses to include an opt-out mechanism in all marketing emails, which allows recipients to easily unsubscribe from future emails. Additionally, the law requires businesses to include their physical mailing address in all marketing emails, and prohibits the use of misleading subject lines and false or misleading header information.

Beyond CAN-SPAM, email marketing is also subject to broader marketing compliance requirements, such as UDAAP or fair lending laws.

You should be monitoring your email marketing campaigns for marketing compliance so that you can avoid spam complaints, protect your email sender reputation, and to ensure they follow the necessary regulatory requirements. Compliance violations in email marketing can result in severe penalties, and can also harm your relationship with your subscribers and customers. By monitoring your email campaigns, you can catch and fix compliance issues before they become a bigger problem.

Social Media

Social media platforms have become the go-to channels for marketers to engage with their audience. With billions of users worldwide, social media presents significant opportunities for businesses to reach their target audience, build brand awareness, and drive sales. However, with the vast volume of content being posted daily, it can be challenging to maintain compliance across these channels.

✅

Ensure compliance on social media by checking out our comprehensive checklist.

One of the biggest challenges for marketers is ensuring that the content posted on social media platforms—from their own organization or from partners and other third parties—complies with the various regulations and guidelines set forth by different countries and industries. Failure to comply with these regulations can result in hefty fines and damage to the brand’s reputation.

Another challenge marketers face on social media is the risk of sensitive data being leaked or violated. With the increasing number of cyber threats, it is crucial for businesses to ensure that their social media accounts are secure and that they have measures in place to protect their customers’ data.

You should be monitoring your social media accounts for marketing compliance so that you can avoid violating advertising regulations and protect your brand’s image. Social media is a powerful marketing tool, but it can also be a compliance minefield. By monitoring your social media accounts, you can catch and fix compliance issues in real-time, before they go viral and harm your reputation.

Call Centers

Call centers remain a primary marketing channel for many businesses, allowing brands to connect with customers in real-time. Call centers are often the first point of contact for customers who have questions or concerns about a product or service. They provide customers with the opportunity to speak with a live representative, which can be a valuable experience for those who prefer human interaction over digital communication.

Monitoring compliance in call centers involves ensuring that agents follow the company’s defined script, adhere to all legal disclosures, and answer customer questions with transparency and honesty. Compliance monitoring can be done through various methods, including call recording and quality assurance evaluations. These evaluations help to identify areas where agents may need additional training or support, as well as areas where the company’s policies and procedures may need to be updated.

In addition to compliance monitoring, call centers can also be used for market research and customer feedback. By collecting data on customer interactions, businesses can gain valuable insights into their customers’ needs and preferences. This information can be used to improve products and services, as well as to develop more effective marketing strategies.

You should be monitoring your call center interactions for marketing compliance so that you can avoid deceptive sales practices and protect your customers. Call centers are heavily regulated, and compliance violations can result in costly fines and legal action. By monitoring your call center interactions, you can identify and address compliance issues and ensure that your agents are providing accurate and truthful information to your customers.

Messages + SMS

Messaging apps and SMS are powerful tools for businesses to reach their customers instantly.

But, these messages are another channel that organizations need to monitor for marketing compliance. The same laws that apply to other marketing channels, such as UDAAP, TILA, and CAN-SPAM, also apply to messaging.

This means that organizations need to ensure that their messages are not deceptive, unfair, or abusive, and that they comply with other relevant laws and regulations. Additionally, messages need to include opt-out options, and organizations need to honor opt-out requests promptly.

You should be monitoring your text messages and other messaging platforms for marketing compliance so that you can avoid violating TCPA regulations and protect your brand’s reputation. Messaging is becoming an increasingly popular marketing channel, but it’s also highly regulated. By monitoring your messages, you can catch and fix compliance issues before they result in costly penalties or harm your relationship with your customers.

Direct Mailers and Physical Collateral

Marketing compliance shouldn’t just be reactive. The best way to prevent any compliance mishaps is with proactive review and approval of pre-production documents (think blogs, direct mailers, one-sheets, etc.) from compliance and legal teams before it’s published and sent out to consumers.

Just because something is a physical print doesn’t make it exempt from regulatory scrutiny. A best practice is to ensure that your marketing and compliance or legal teams have a standard process for getting approvals to get content out the door quickly. Your organization may opt for an automated compliance solution for quick review and approval.

You should be monitoring your direct mailers and physical collateral for marketing compliance so that you can avoid violating advertising regulations and protect your brand’s image. Compliance violations in direct mailers and physical collateral can result in costly fines and damage to your reputation. By monitoring these materials, you can catch and fix compliance issues before they go to print and harm your brand.

Implementing a marketing compliance management system

A compliance management system is a structured approach to ensure an organization is meeting its legal and regulatory requirements. It includes policies, processes, and procedures that an organization implements to identify, assess, manage, and monitor compliance risks. The purpose of a compliance management system is to ensure that an organization is operating within the bounds of applicable laws and regulations and to prevent or mitigate potential compliance issues before they become a problem.

In the context of marketing compliance, a compliance management system would help an organization manage and monitor their marketing activities to ensure that they are compliant with relevant regulations and policies.

One of the most effective ways to manage marketing compliance is through an omni-channel marketing compliance monitoring technology. This technology can help organizations monitor marketing activities across all channels, including social media, email marketing, direct mailers, messages, call centers, and web pages. By using such technology, organizations can track their marketing campaigns, identify compliance risks, and take corrective actions in real-time.

Moreover, an omni-channel marketing compliance monitoring technology can help organizations ensure compliance with various regulations, such as UDAAP, TILA, and other consumer protection laws.

Benefits of an omni-channel marketing compliance software

Implementing an omni-channel marketing compliance software can have a significant positive impact on your compliance management system (CMS) and overall marketing operations.

Here are some key benefits of using an omni-channel marketing compliance software:

- Centralized compliance management: With an omni-channel marketing compliance software, you can consolidate all compliance monitoring and reporting into one centralized platform. This allows you to manage compliance across all marketing channels, such as web content, social media, email marketing, and physical collateral, from one place.

- Automated compliance monitoring: An omni-channel marketing compliance software can automatically monitor all marketing channels for compliance violations. This ensures that you stay compliant and saves you time and resources by automating the monitoring process.

- Customizable compliance rules: An omni-channel marketing compliance software can be customized to meet your specific compliance needs. You can set up compliance rules and thresholds that are specific to your industry, company, or product, and the software will automatically flag any content that violates those rules.

- Real-time alerts and remediation: An omni-channel marketing compliance software can provide real-time alerts and remediation options when compliance violations are detected. This allows you to quickly address compliance issues and reduce the risk of penalties and legal issues.

- Enhanced reporting and analytics: An omni-channel marketing compliance software can provide detailed reporting and analytics on compliance across all channels. This allows you to identify compliance trends, measure compliance performance, and optimize compliance strategies.

- Cost savings: Implementing an omni-channel marketing compliance software can also result in significant cost savings. By using a single platform to manage compliance across all channels, you eliminate the need for multiple-point solutions that don’t talk to each other. This not only reduces the cost of purchasing and maintaining multiple systems but also reduces the risk of errors and inconsistencies that can lead to compliance violations. You can save time and resources that would otherwise be spent manually reviewing and approving marketing materials, allowing your compliance team to focus on higher-value activities.

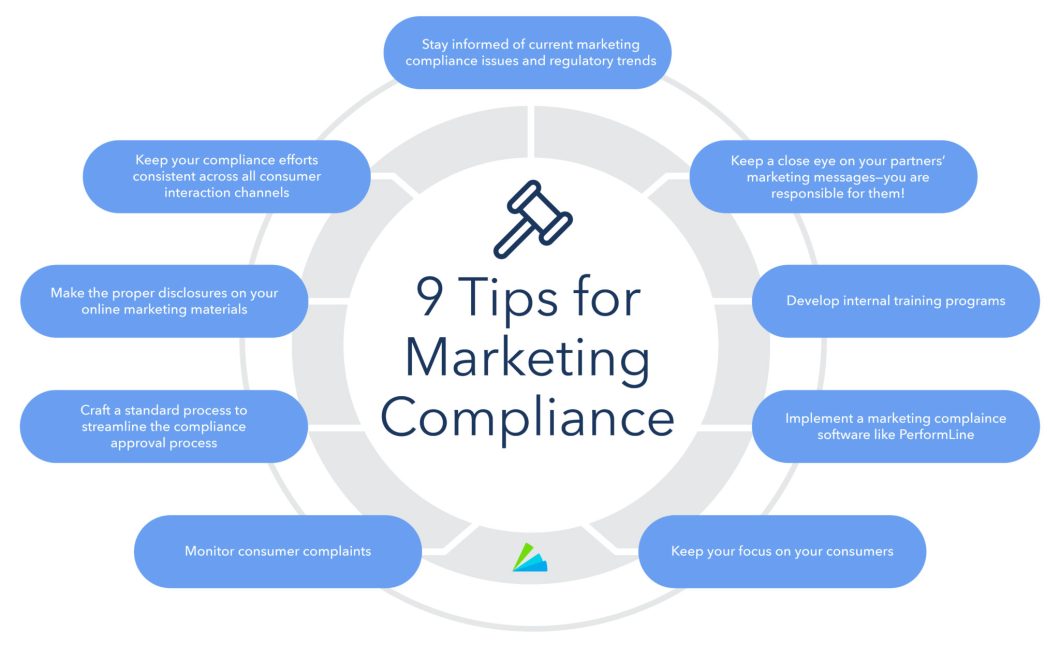

9 tips for marketing compliance

Keep your compliance efforts consistent across all of your consumer interaction channels

When it comes to marketing compliance, it’s crucial to keep your efforts consistent across all of your consumer interaction channels. It’s easy to get caught up in compliance for just one channel, such as email marketing, and neglect to ensure compliance across other channels such as social media, call centers, and physical collateral. However, this can be a costly mistake.

Regulations apply to all mediums, so it’s important to take a holistic approach to compliance. Whether you’re promoting your products and services online, over the phone, or through the mail, it’s critical to ensure that your marketing materials comply with applicable laws and regulations. For example, the FTC’s Telemarketing Sales Rule applies to telemarketing calls, but also extends to text messages, voicemail messages, and faxes.

Make the proper disclosures on your online marketing materials

These days, digital advertising is a staple in just about every organization’s marketing efforts. Any required disclosures must be clear and conspicuous, meaning easy to understand and difficult to miss for consumers. Some considerations for making your disclosures include:

- Proximity to the claim

- Prominence of the disclosure

- If other parts of the ad distract from the disclosure

- If the disclosure needs to be repeated in different places (such as on a website)

Craft a standard process to streamline the compliance approval process

Compliance approval processes can be time-consuming and costly, especially when you are dealing with multiple marketing channels. To optimize the process and ensure that your marketing efforts are compliant, it is important to craft a standard process that can be applied across all channels.

The first step in crafting a standard process is to identify all of the compliance requirements for each channel. This includes understanding the specific regulations and guidelines that apply to each channel, as well as any industry-specific requirements.

Once you have identified the compliance requirements, you can begin to develop a standardized process for compliance approval. This process should include clear guidelines for content creation, approval workflows, and reporting procedures.

To ensure that the process is effective, it is important to involve all relevant stakeholders in the development of the process. This includes compliance teams, marketing teams, and any other relevant departments.

Monitor consumer complaints

Monitoring consumer complaints is beneficial for a few reasons.

Monitor complaints submitted to your own company, as well as to regulators (like the CFPB) to:

- Resolve consumer issues quickly and maintain brand reputation

- Mitigate your risk of enforcement actions from regulators like the CFPB, FTC, and State AGs

- Identify root causes of any issues or other lapses in your compliance or customer service functions

Monitor complaints about your competitors and other organizations in your industry to:

- Understand industry-wide trends and pain points to get out ahead of issues

- Gain a competitive advantage over your competitors by understanding their weaknesses and adjusting your processes accordingly

Richard Cordray, former CFPB Director, emphasized the value of monitoring complaints submitted to the Bureau’s Consumer Complaint database saying:

“The database is especially valuable, as the data provided gives you a window into what’s going on at other companies in their whole industry, as opposed to just hearing what your own customers are saying”

Keep the focus on your consumers

It’s easy to get caught up in your own marketing efforts and lose sight of what’s most important—the customer.

We live in a consumer-centric world, especially in the financial services industry. As an organization that provides products and services to consumers and is heavily regulated to ensure consumer protection, it’s critical to always cater to the needs of your customers by providing transparent and clear communication.

📝

Understand the latest consumer complaint trends with our informative infographic.

Here are some questions to consider as you’re drafting up content:

- Does this have the consumer’s best interest in mind?

- Could this message be confusing for consumers?

- Would regulators find this message unfair, deceptive, misleading, or abusive in any way?

- Can I make this message any more clear or concise?

Taking a step back to ask these questions will not only benefit the consumer, but it will help mitigate compliance risk and protect your organization from enforcement actions from the regulators.

Stay informed of current marketing compliance issues and regulatory trends

Staying informed of what’s happening within your industry is one of the easiest ways to avoid violations and hefty fines. Check the CFPB newsroom, FTC press releases, and PerformLine’s blog to stay up to date on the possible risks that are associated with changes to compliance policy and law.

📊

Get the latest insights and trends in marketing compliance with our State of Marketing Compliance Benchmarking & Trends Report.

Consider setting up Google Alerts to be delivered to your inbox every morning with relevant keywords, regulations, or phrases relevant to your industry (that’s what we do!).

Finally, keep an eye on recent enforcement actions to identify any trends.

Foster a culture of compliance within your marketing team and the rest of the organization

Fostering a culture of compliance within your marketing team and the rest of the organization is essential for ensuring that compliance is a top priority at all times.

Here are some steps for creating a culture of marketing compliance:

- Lead by example: As a leader, it’s important to set the tone for compliance by adhering to regulations yourself. Make sure you’re following best practices and communicating the importance of compliance to your team

- Train your team: Provide regular compliance training to your marketing team and ensure that they understand the rules and regulations that apply to your industry. This will help them make informed decisions and reduce the risk of compliance violations.

- Encourage questions: Encourage your team to ask questions and seek clarification on compliance issues. This will help ensure that everyone is on the same page and that compliance is a collaborative effort.

- Celebrate compliance successes: When your team successfully navigates a compliance challenge or implements a new compliance process, make sure to celebrate their success. This will help reinforce the importance of compliance and encourage a culture of continuous improvement.

- Make compliance a part of your company values: Incorporate compliance into your company values and ensure that it’s emphasized throughout your organization. This will help create a culture of compliance that extends beyond the marketing team and into the rest of the organization.

Keep a close eye on your partners’ marketing messages—you are responsible for them!

Regulators are cracking down on deceptive marketing tactics used by partners and other third parties. Your company assumes all the risk of what these third parties say on your behalf. Once you’ve included clear and non-deceptive disclosures in your ads, make sure that your partners are doing the same.

To mitigate these risks, it’s important to keep a close eye on your partners’ marketing messages. This can include setting clear guidelines for partners to follow and monitoring their compliance with those guidelines. It may also involve conducting regular audits of partner marketing activities to ensure compliance.

In addition, it’s important to foster a culture of compliance among your partners. This can involve providing training and resources to help them understand the regulations and guidelines they need to follow, as well as offering ongoing support to help them stay compliant.

Develop internal training programs

Your team can’t comply with regulatory requirements if they aren’t aware of their compliance responsibilities and how to handle them.

📚

Show your team these real-world examples of UDAAP violations to improve their understanding and compliance.

Hold monthly or quarterly training sessions to help your staff understand expectations and their role in upholding compliance. These training sessions can also include any new or updated regulations, relevant articles, and important company and industry updates.

Implement a marketing compliance software like PerformLine

As marketing compliance becomes increasingly important, companies are turning to technology solutions to help manage the complexity of monitoring and maintaining compliance across all channels.

PerformLine offers a centralized platform for managing compliance across all marketing channels, including web content, social media, email marketing, call centers, messages, and documents.

One of the key benefits of using a marketing compliance software like PerformLine is the ability to save time and resources by automating compliance monitoring. With PerformLine, you can identify and flag compliance issues in teal-time and quickly send out remediation notices to address any issues before they become a bigger problem.

Another advantage of PerformLine is its advanced reporting and analytics capabilities. PerformLine’s Business Intelligence solution provides detailed compliance reports and analytics, allowing businesses to identify compliance trends, measure performance, and optimize their compliance strategies.

Using a marketing compliance software like PerformLine can help ensure that your company stays compliant across all channels and avoids costly penalties and legal issues. With its automated monitoring, customizable compliance rules, and detailed reporting, PerformLine is an excellent solution for businesses looking to streamline their compliance efforts and protect their brand reputation.

5 signs it’s time to invest in a marketing compliance software

1. Your current compliance program is constrained by manual review

Do you have a compliance program in place, but feel like there aren’t enough hours in the day to review everything that could be non-compliant?

Does your compliance team spend the majority of their time on manual review of marketing materials?

Do you wish you could add a few more people to your team to stay ahead?

It may be time to invest in software to help accelerate your marketing compliance program. PerformLine’s automated compliance monitoring solution provides one single platform for regulatory and brand compliance across all of the marketing channels you use to interact with consumers.

2. The majority of your documents being submitted for review require revisions due to a compliance issue

Is your team reviewing more than 50 marketing pieces a month for regulatory and brand compliance?

Do the majority of those pieces require revisions due to a compliance issue?

Does your review process involve several rounds of back and forth for edits and revisions?

Data from the PerformLine Platform shows that 51% of documents submitted for review in 2021 had at least one compliance issue that needed revision. With PerformLine’s Document Review, marketing assets (like blog posts, direct mailers, and brochures) are automatically ingested and reviewed to provide fast and accurate compliance verdicts.

3. You’re not able to monitor all assets from your third parties and partners for compliance

Do a number of third parties/partners you work with who market on behalf of your company?

Are you able to monitor everything being used by these third parties for compliance issues?

Of the items being monitored, do a high percentage require remediation?

Ensure 100% of your third parties are being monitored for compliance all the time and across all the channels your brand is being mentioned. Learn how PerformLine can automate and scale compliance across all of your third parties, partners, and individual contributors.

4. You find it difficult to keep up with regulatory changes

Is it difficult to stay on top of the ever-changing regulatory changes for your industry?

Do federal regulatory changes, UDAAP, fair lending, and data privacy and protection laws keep you up at night?

Do you have a process in place to implement these changes immediately within your compliance program?

At PerformLine, we have years of experience with regulators and clients in regulated industries. Built off this industry expertise, our proprietary, turn-key rulebooks are ready-to-use and cover the regulatory guidelines applicable to your industry – but are customizable to fit your needs. Learn more about PerformLine’s industry expertise and rulebooks.

5. You utilize an omni-channel marketing approach, but lack omni-channel compliance monitoring

Do you lack compliance monitoring on at least one marketing channel that you’re currently using?

Do you need a way to quickly scale monitoring rules from one marketing channel to another?

Do you know which marketing channels create the most compliance violations?

No more duplicating efforts on hard-to-scale, single-point solutions for each channel. All marketing channels have the potential for compliance issues, don’t leave yourself exposed to risk. Get the full compliance picture with PerformLine’s omni-channel platform.

The Bottom Line

Take The Steps Needed To Achieve Marketing Compliance

Technology can automate many steps of your compliance efforts. With the help of an automated platform, potential compliance issues can be automatically discovered, tracked, and remediated across all of those sources.

PerformLine helps organizations of all sizes monitor their marketing and sales content across the web, call, message, email, and social media channels for regulatory and brand compliance. We’re here to help your brand mitigate compliance risks and ensure brand safety.