Omni-Channel Compliance

Powerful Alone. Invincible Together.

Simplify Your Tech Stack With One Platform

Omni-Channel Compliance

Simplify Your Tech Stack With One Platform

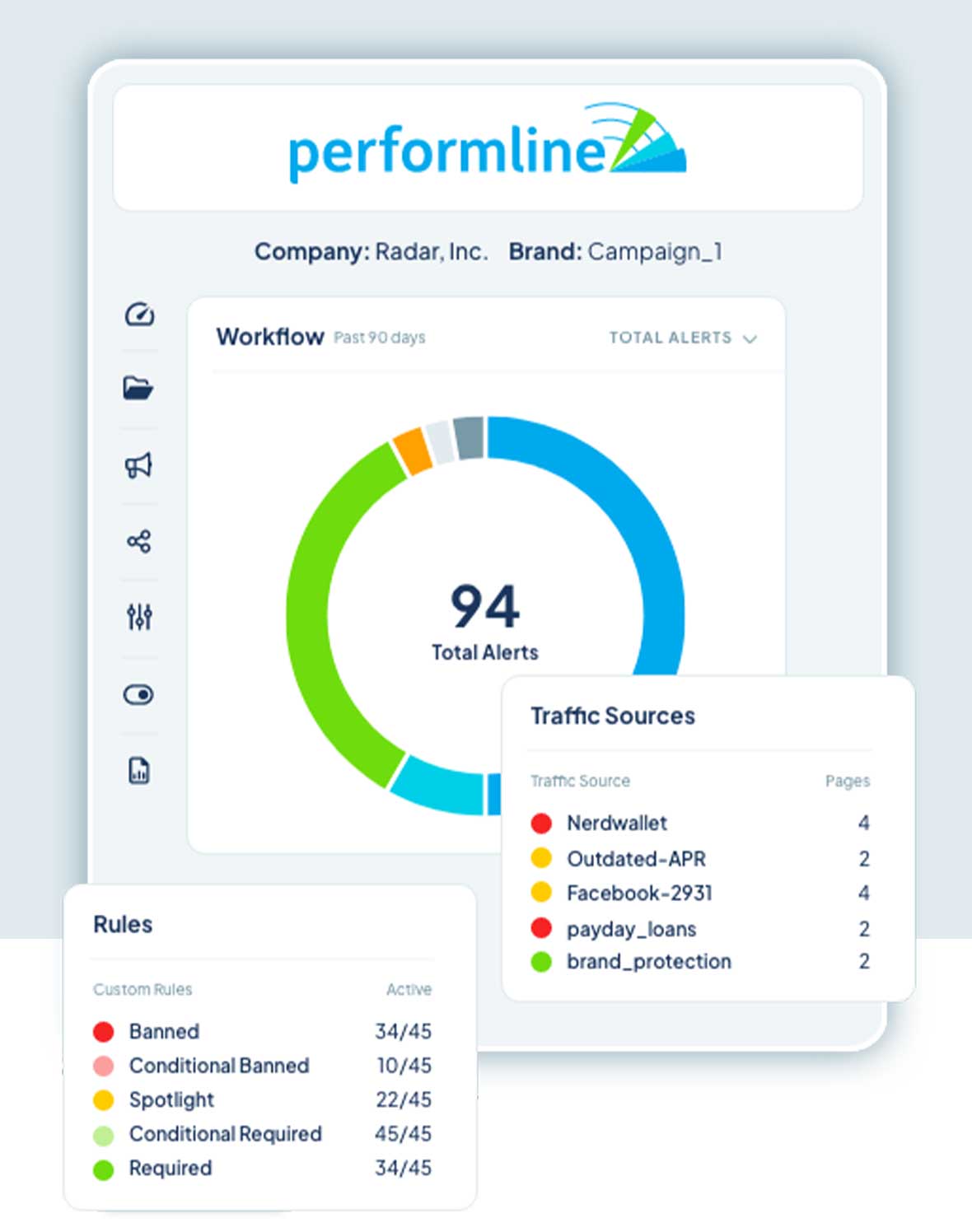

Find the web pages, emails, and social posts made by third party partners to ensure compliant promotion.

Demonstrate a commitment to marketing compliance and consumer protection with always-on discovery and monitoring.

PerformLine’s library of proprietary industry rulebooks is ready to deploy and cover a number of regulations that could impact fintechs, such as the Truth in Lending Act (TILA), Regulation Z, and UDAAP.

Maximize time and cost savings by consolidating compliance efforts into one comprehensive platform.

Demonstrate to your bank partners and regulators that you’re taking the necessary steps to ensure compliance with a complete history of discovery through remediation for any audit situation.

PerformLine enables fintech compliance teams to identify and address compliance risk through our end-to-end solution, from marketing material review to remediation.

PerformLine replaces the need for multiple, disconnected solutions and provides a centralized, scalable omni-channel marketing compliance management process for fintechs. Experience total efficiency with PerformLine’s all-in-one solution–One Platform, One Process, One Truth.

How Acima uses PerformLine to achieve complete compliance oversight across 5 marketing channels

Additional Content

Fintechs can monitor their affiliate partners for compliance using PerformLine’s omni-channel compliance platform to automate and scale marketing compliance reviews and monitoring.

Fintechs should use PerformLine to monitor a range of marketing channels for compliance, including the web, calls, emails, messages, and social media. Fintechs should also review and approve marketing collateral from affiliates for compliance prior to publication.

Yes, PerformLine’s marketing compliance monitoring solution is designed to adapt to changes in fintech regulations and industry standards.

PerformLine’s marketing compliance monitoring solution can help fintechs ensure affiliate partners are in compliance by automating compliance monitoring of affiliate websites, identifying compliance gaps, and centralizing compliance management.

Using sophisticated AI and machine learning, PerformLine can discover previously unknown webpages, landing pages, offers or emails that affiliate partners are promoting to consumers that you may not know about. PerformLine then monitors and scores those webpages, emails, or social posts against your rules to identify non-compliant promotion.

PerformLine’s Business Intelligence provides detailed reporting and analytics that help fintechs understand the compliance risks associated with their affiliates, including industry benchmarking data, affiliate partner compliance performance, trends over time, workflow activity, and more.