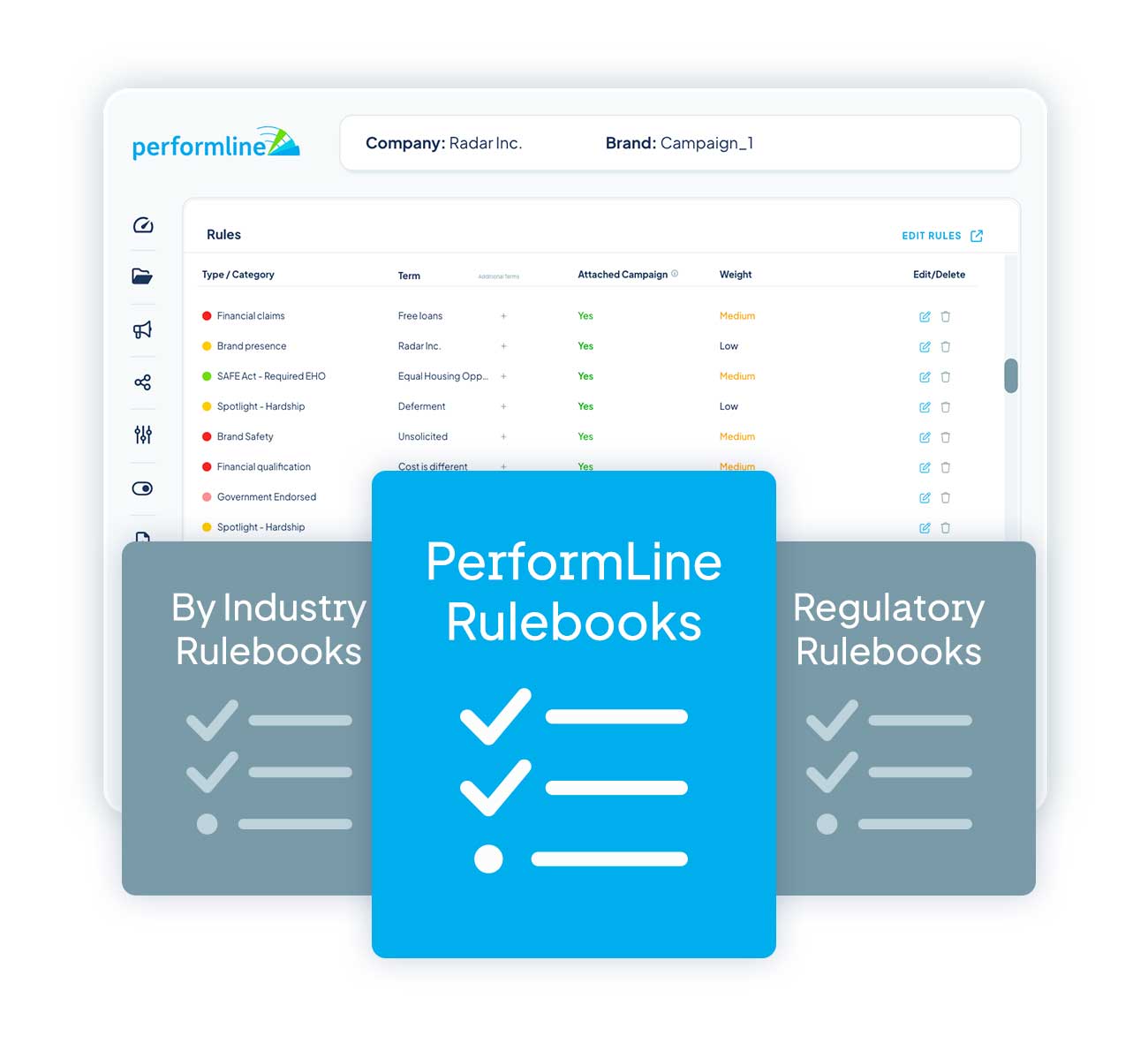

The Power of PerformLine’s Proprietary Rulebooks

Regulatory Compliance Rulebooks

Regulatory Rulebooks That Power Enterprise Compliance

Refined with experience and a track record of success across client compliance programs since 2007, PerformLine’s proprietary rulebooks are the foundation for top-performing enterprise compliance programs.

Industry Expertise

Built on years of experience with regulators and clients in regulated industries, our comprehensive rulebooks are built for the Banking, BNPL Lending, Credit Card, Mortgage, FinTech, Alternative Lending, Gig-Economy, Education, Technology, and Healthcare industries

Regulations Demystified

Our rulebooks are crafted from regulatory bulletins, acts, documents, settlements, and industry standards from governing bodies including the CFPB, FTC, FCC, SEC, ED, OCC, FINRA and more

Easy to Use

No coding or technical experience is required to use our rulebooks. They are pre-built but easy to modify for regulations or your own brand rules.

Rules Your Way

Turn-Key

Ready to deploy, yet easy to modify in real time

Control Risk Threshold

Set weightings to match your risk thresholds on individual rules or entire rulebooks

Play By Your Rules

Add your own rules to meet your enterprise compliance needs

Get Started Right Away

Popular Rulebooks

- Dodd-Frank Act (Dodd-Frank Wall Street Reform and Consumer Protection Act)

- UDAAP (Unfair, Deceptive or Abusive Acts or Practices)

- CARD Act (Credit Card Accountability, Responsibility and Disclosure Act)

- TCPA (Telephone Consumer Protection Act)

- Higher Education Act

- TILA (Truth in Lending Act)

- RESPA (Real Estate Settlement Procedures Act)

- Federal Trade Commission Act

- Map Rule (The Mortgage Acts and Practices Advertising Rule) and Regulation N

- ERISA (Employee Retirement Income Security Act)

- GLBA (Gramm-Leach-Bliley Act)

- CARES Act (The Coronavirus Aid, Relief, and Economic Security Act)

- The Patriot Act

- FDCPA (Fair Debt Collection Practices Act)

- SAFE Act (Secure and Fair Enforcement for Mortgage Licensing Act)

Keep It Simple

Discover. Monitor. Act.

PerformLine empowers compliance teams to take control of their marketing compliance program

Deploy Across All Channels

Keep a rule repository to deploy your rulebooks consistently and easily across your entire compliance program

Contextual Relevancy

Context matters and our approach provides exceptions for in context-dependent situations to reduce false-positive results for fine-tuned compliance coverage

Multi-Language

Monitoring for languages such as Spanish, Dutch, French, German, Italian, and Portuguese is easy to implement and provides oversight for more consumer interactions

Centralized Knowledge

One rulebook repository used across all monitored channels allows for centralized knowledge to drive faster resolutions, reduce risk, create efficiencies and provide deep insights