Omni-Channel Compliance

Powerful Alone. Invincible Together.

Simplify Your Tech Stack With One Platform

Omni-Channel Compliance

Simplify Your Tech Stack With One Platform

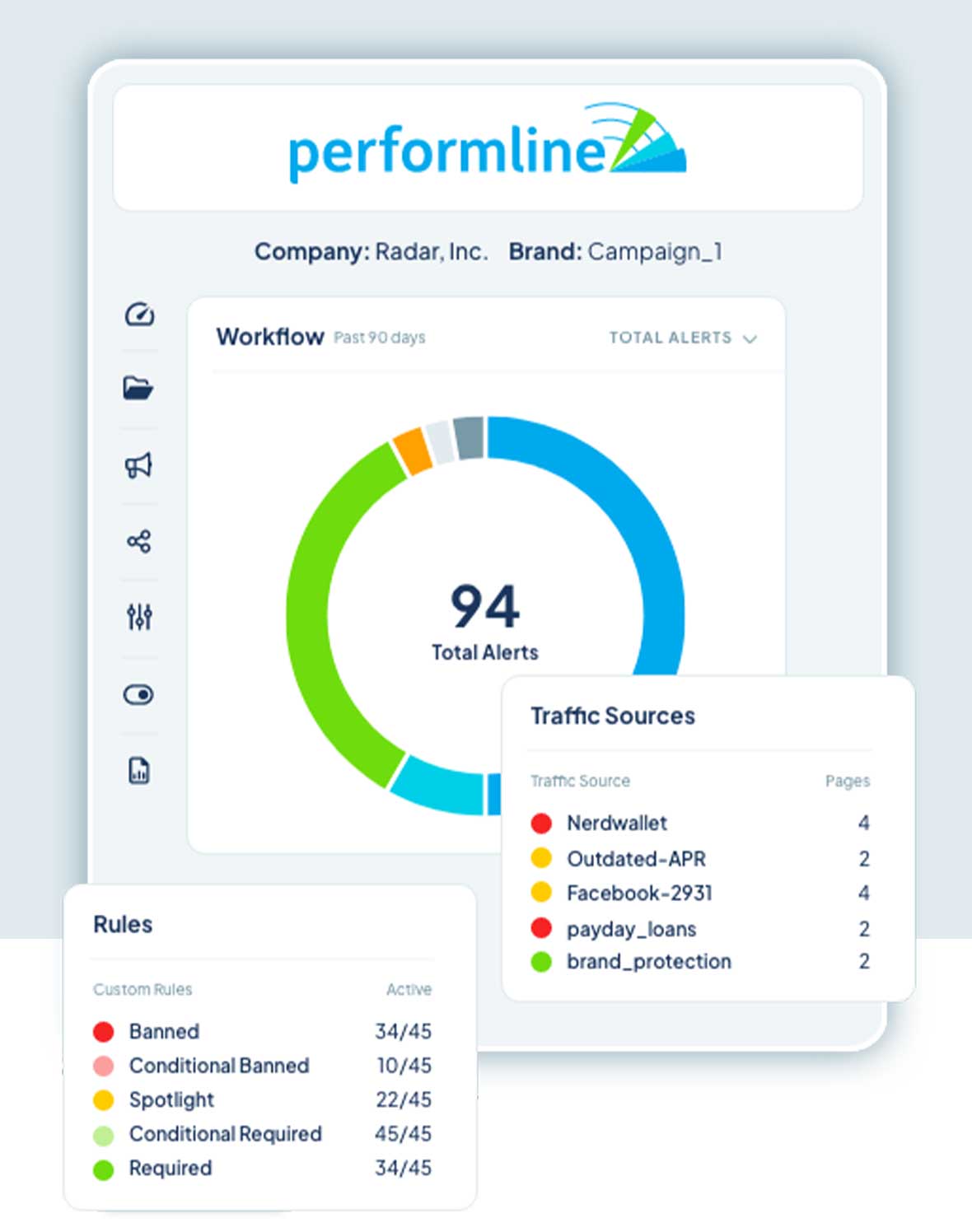

Find the web pages, emails, and social posts made by agents, affiliates, and third parties to ensure compliant promotion.

Demonstrate a proactive commitment to marketing compliance and consumer protection with always-on discovery and monitoring.

PerformLine’s library of proprietary industry rulebooks are ready to deploy and cover a number of regulations that could impact insurance providers, including UDAAP.

Maximize time and cost savings by consolidating compliance efforts into one comprehensive platform.

Be ready to demonstrate to regulators that you’re taking the necessary steps to ensure compliance with a complete history of discovery through remediation for any audit situation.

PerformLine enables insurance compliance teams to identify and address compliance risks through our end-to-end solution, from marketing material review to remediation.

PerformLine replaces the need for multiple, disconnected solutions and provides a centralized, scalable omni-channel marketing compliance management process for insurance providers. Experience total efficiency with PerformLine’s all-in-one solution – One Platform, One Process, One Truth.

Additional Content

Insurance companies can use PerformLine’s omni-channel compliance platform to automate and scale marketing compliance reviews and monitoring for their affiliate partners.

Insurance companies should use PerformLine to monitor a variety of consumer marketing channels for compliance, including the web, calls, emails, messages, and social media. Insurance companies should also review and approve marketing collateral from affiliates for compliance prior to publication.

Using PerformLine’s marketing compliance technology, insurance companies should monitor for (but are not limited to) regulations like the Fair Credit Reporting Act (FCRA), the Telephone Consumer Protection Act (TCPA), Unfair, Deceptive or Abusive Acts or Practices (UDAAP), state regulations, and other consumer protection and data privacy laws.

Yes, PerformLine’s marketing compliance monitoring solution is adaptable to ever-changing regulations and industry guidelines, making it an ideal solution for insurance companies to future-proof their compliance programs.

Using sophisticated AI and machine learning, PerformLine can discover previously unknown webpages, landing pages, offers or emails that partners are promoting to consumers that you may not know about. PerformLine then monitors and scores those webpages, emails, or social posts against your rules to identify non-compliant promotion.

PerformLine’s marketing compliance solution can help insurance companies manage the risks associated with their affiliates by automating compliance monitoring of affiliate websites, identifying compliance gaps, and centralizing compliance management.

PerformLine’s Business Intelligence provides detailed reporting and analytics for insurance companies, including industry benchmarking data, affiliate compliance performance, trends over time, workflow activity, and more.