Marketing Compliance Risks from Consumer Complaints to the CFPB [Data]

A recent analysis of consumer complaints submitted to the Consumer Financial Protection Bureau (CFPB) uncovered several key trends presenting regulatory compliance risks for consumer finance organizations.

Here are the top consumer complaint data points from the CFPB’s Consumer Complaint Database that you should know, the compliance risks they present, and how to get out ahead of regulatory scrutiny.

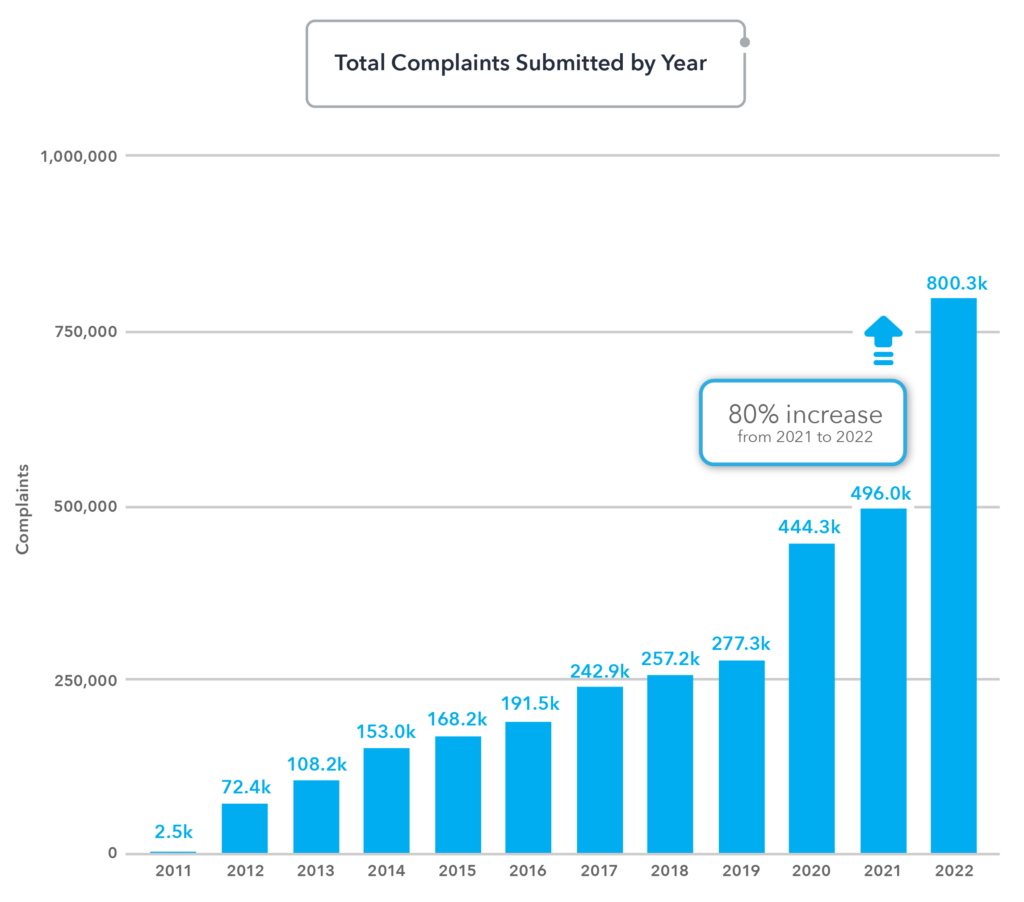

Consumer complaints are continuing to increase year-over-year

Every year, consumers submit more complaints than they did the last. Since the creation of the CFPB, there has never been an instance where complaint counts decreased from one year to the next.

Consumers submitted over 800,000 complaints in 2021—a significant and alarming increase with a record-breaking number that rose by 80% compared to the previous year.

Notably, these complaints account for nearly one-fourth (25%) of all complaints received by the CFPB since its establishment in 2011.

What’s the risk? Consumers have a heightened sensitivity and awareness of how they’re being treated by consumer finance organizations. Consumers are also increasingly being empowered by the CFPB to use their voices to let them know what challenges they’re facing in the marketplace.

How to get out ahead: Consumer protection should be at the forefront of your business objectives. Compliance programs should utilize a proactive approach to protect consumers before they face challenges and submit their complaints to the CFPB.

Let us help you: PerformLine’s omni-channel compliance solution allows your organization to be proactive in consumer protection efforts to avoid the complaints that lead to regulatory scrutiny from the CFPB and other regulators. Learn more

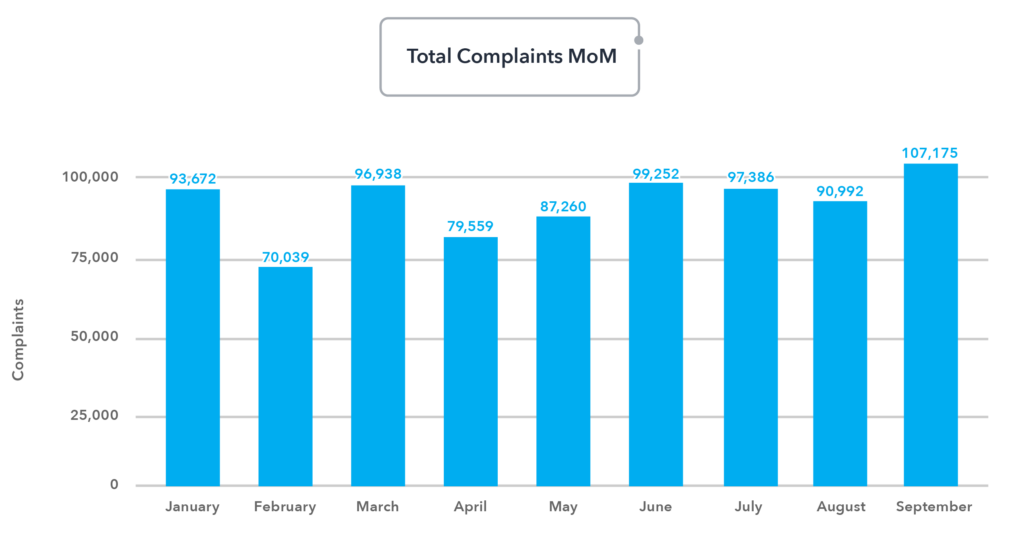

2023 consumer complaint volume has already surpassed 2022 volume

2023 is already another year of unprecedented consumer complaints to the CFPB.

As of the end of September 2023, there are over 900k consumer complaints in the CFPB’s database—a 62% increase from the same time frame in 2022, and a 12% increase from the total complaints submitted in 2021.

What’s the risk? Consumer complaints are a guiding factor for the CFPB’s supervisory and enforcement actions.

The CFPB uses this [complaint] information to monitor risk in financial markets, assess risk at companies, and prioritize agency action. The CFPB makes complaint data and analyses readily available to CFPB staff to support their supervisory, enforcement, and market monitoring activities.

– The CFPB

As the CFPB continues to receive unprecedented numbers of complaints, paired with CFPB Director Rohit Chopra’s aggressive approach to consumer protection, compliance risk increases significantly.

How to get out ahead: By proactively monitoring marketing communications for compliance, your organization can better protect consumers and avoid the complaints that lead to investigations and enforcement actions by the CFPB.

Let us help you: With PerformLine, your organization can get complete compliance coverage of all your marketing materials across channels and partners—discovering placements you may not have even known about. Learn more

For each product, there are generally 3 main issues that make up the majority of complaints

![Pie Charts: Marketing Compliance Risks from Consumer Complaints to the CFPB [Data]](https://performline.com/wp-content/uploads/2023/09/top-complaint-issues-by-product-1024x653.png)

When looking at each product category in the CFPB’s Consumer Complaint Database, the top 3 issues make up at least half of the total complaints per product.

What’s the risk? Consumers face similar challenges with products across the board. If you fail to monitor for these top issues for the product(s) you offer, you could be exposing your organization to risk.

Consumer complaints can be an indicator of potential risk management weaknesses or other deficiencies, such as violations of laws or regulations. Complaints can reveal a weakness in a particular product, service, function, department, or vendor.

– The CFPB

How to get out ahead: By understanding exactly what it is that consumers are complaining about, you can make it a priority to address these issues within your company and ensure you are preventing and/or responding to these issues in order to get ahead of the rest

Let us help you: PerformLine’s omni-channel solution comes with pre-built regulatory compliance rulebooks that include the top issues for your industry and product(s), taking the guesswork out of compliance monitoring across the channels where your organization interacts with consumers. Learn more

Complaints submitted by special groups increased in 2022

Complaints submitted by military servicemembers increased 67% in 2022

Consumer complaints submitted by military servicemembers jumped significantly in 2022, up 67% since 2020.

What’s the risk? Servicemembers’ complaints increased significantly between 2021 and 2022, particularly regarding digital payment apps, according to the CFPB’s latest Office of Servicemember Affairs Annual Report.

How to get out ahead: Military servicemembers are particularly vulnerable to financial harm due to their unique circumstances. Military servicemembers and their consumer protection laws should be included as part of your overall compliance program.

Let us help you: PerformLine’s compliance monitoring solution can help monitor for compliance issues specific to military servicemembers and ensure compliance with applicable consumer protection regulations, including the Military Lending Act (MLA), Fair Debt Collection Practices Act (FDCPA), and more. Learn more

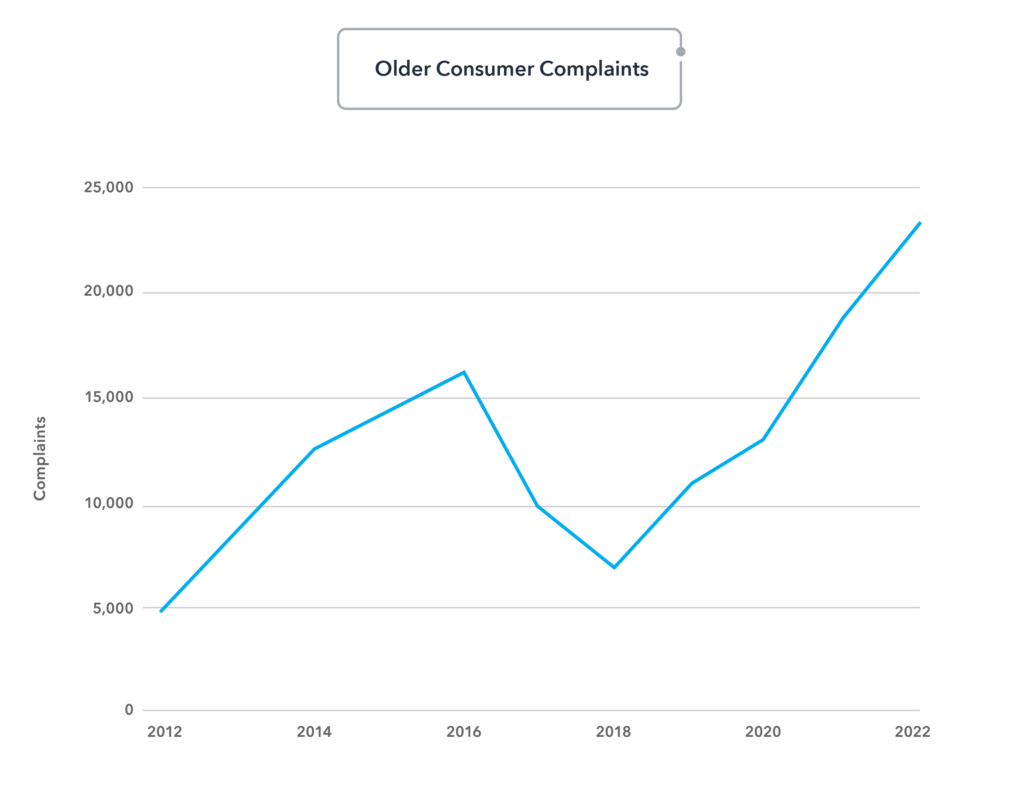

Complaints submitted by older consumers increased 25% in 2021

What’s the risk? In the CFPB’s Consumer Protection Circular 2023-01, the Bureau notes that they received complaints—specifically noting those from older consumers about being repeatedly charged for products or services they did not intend to purchase or no longer wish to continue (“negative option marketing”).

How to get out ahead: Consumer finance organizations must ensure transparent marketing materials, obtain informed consent, simplify cancellation processes, and prevent unauthorized charges to comply with regulations and address consumer concerns effectively.

Let us help you: With PerformLine’s regulatory compliance monitoring solution, your organization can ensure that communication is clear across all of your marketing channels, from calls to emails. Learn more

Mitigate Compliance Risks and Consumer Complaints with PerformLine

Prevent consumer complaints and compliance issues by getting to the root of them—deceptive and unclear marketing communications that cause consumer harm.

With PerformLine, your organization can get out ahead of regulatory scrutiny from the CFPB with:

- An agile compliance program that adapts as the regulatory environment changes and new risks emerge

- A proactive approach to consumer protection to help prevent consumer complaints that lead to investigations and enforcement actions by the CFPB

- Ready-to-use but customizable rulebooks to cover existing regulations and guidelines, as well as new compliance risks and issues that arise

Let us help you—schedule a demo with our team of experts today.