Marketing Compliance Enforcement Action Stats & Themes: 2H 2023

In the second half of 2023, federal and state regulators were particularly active, finalizing over 20 enforcement actions against consumer finance companies, totaling over $200 billion in penalties and fees.

These actions highlight a few important trends: a crackdown on misleading and unfair practices, big penalties for companies that break the rules, and a focus on how companies manage their third-party relationships.

Here are the key marketing compliance and regulatory enforcement action insights that consumer finance companies should know.

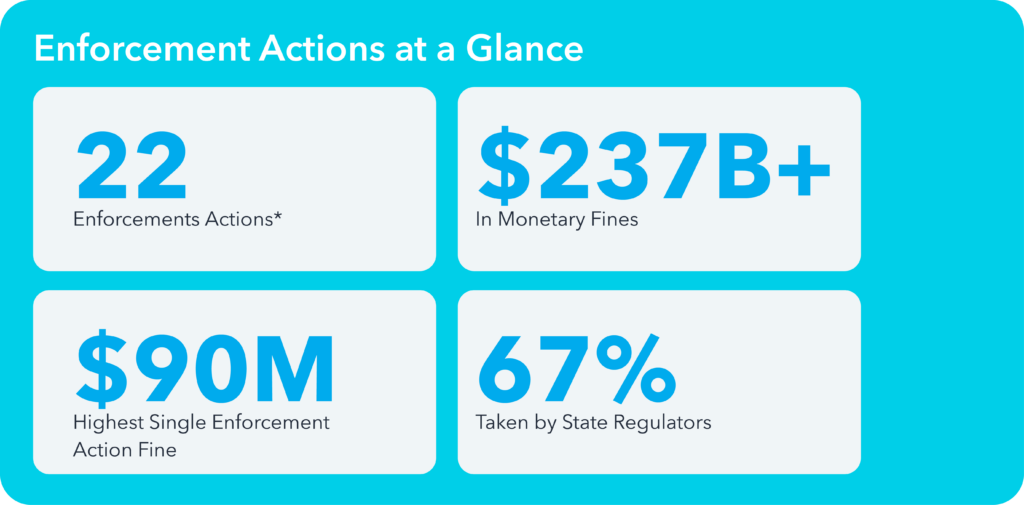

Enforcement Actions at a Glance

In the second half of 2023, federal and state regulators finalized 22 enforcement actions, totaling over $237 billion in monetary fines.

The highest monetary fine from a single enforcement action is $90 million, which was taken against a bank by the Consumer Financial Protection Bureau (CFPB). However, a related enforcement action was taken against the same bank by the Office of the Comptroller of Currency (OCC). Between the CFPB and the OCC, this bank was ordered to pay a combined total of $150 million in monetary fines for UDAAP violations.

While federal regulators—including the CFPB, the OCC, and the Federal Trade Commission (FTC)—were busy, the majority (67%) of these finalized enforcement actions came from state regulatory agencies—specifically New Jersey, Texas, Oregon, and Washington.

Key Enforcement Themes

UDAAP and dark patterns

Regulators are increasingly scrutinizing deceptive advertising and the use of “dark patterns”—design choices that manipulate or heavily influence users to make decisions not in their best interest.

We saw several instances of this focus in the second half of 2023, particularly with a number of UDAAP enforcement actions.

For example, the FTC took action against a fintech company for using deceptive advertising and confusing cancellation processes. The fintech promised “instant” cash advances up to $250 with “easy cancellation,” but in reality, they charged a 99-cent fee for instant transfers and made it difficult to cancel subscriptions, even continuing to withdraw a $9.99 monthly fee until the advance was paid off.

A CFPB enforcement action was taken against a fintech for making false promises in marketing materials on social media, saying that transfers would be delivered “instantly” or “within seconds,” when in most cases, transfers took much longer than just seconds. They also claimed that transfers would incur “no fees,” but customers were, in fact, charged fees for their transfers.

In another joint regulatory enforcement action, the CFPB and 11 States went after a company for making false promises of job placement, trapping students with “income share” loans, and resorting to abusive debt collection practices when borrowers could not pay.

Monetary and structural penalties

Enforcement actions resulted in not just significant financial penalties, but expanded to structural penalties like mandatory policy changes, operational shutdowns, and requirements for improved disclosures and consumer-friendly practices.

The NJ State Attorney and Divison of Consumer Affairs took action against a mortgage company for bombarding consumers with harassing sales calls about loan refinancing, engaging in bait-and-switch sales tactics to induce them to refinance their loans, and causing them financial harm by repeatedly failing to meet its responsibilities as a loan servicer. On top of its monetary penalty, the servicer was also ordered to designate an employee to serve as the company’s Complaint Coordinator for a period of 18 months, who will be responsible for ensuring the company complies with the terms of the consent order and all other consumer protection laws and regulations.

A more serious structural penalty imposed by regulators in the second half of 2023 was against the company (mentioned above) that tricked consumers into income share loans and used abusive debt collection practices—not only did the enforcement order require the company to pay a hefty fine and refund all money to its borrowers, but was also ordered to shut down permanently.

Risk management for third-party relationships

As bank-fintech partnerships and the banking-as-a-service (BaaS) industry continue to grow, organizations are expected to have robust risk management strategies in place for partners, which was reflected by a consent order sent out by the Federal Deposit Insurance Corporation (FDIC).

The FDIC said the bank engaged in deceptive and unfair acts and practices by implying that certain credit products with non-optional debt cancellation features were unemployment insurance, and approving consumers who did not qualify for the debt cancellation feature while misrepresenting the fees for those products.

As part of the consent order, the bank is required to obtain written non-objection from the FDIC before onboarding new fintech partners. It must also review, revise, develop, and implement policies, procedures, and training to enhance compliance with consumer protection laws and complete regular internal reviews and independent audits.

What this means moving forward

These recent regulatory enforcement actions and themes serve as a reminder of the importance of investing in comprehensive risk and compliance management, consumer-first business practices, and a deep understanding of regulatory landscapes.

Marketing compliance and consumer protection are no longer just “nice to have”—they’re an integral part of any successful consumer finance company. Failure to comply with regulations and protect consumers can lead to hefty monetary penalties, reputational damage, loss of consumer trust and loyalty, and even mandatory shutdowns.

Staying on top of the latest enforcement and compliance trends is a critical step in fulfilling regulatory obligations and protecting consumers.

Get the full marketing compliance enforcement actions report

PerformLine’s Marketing Compliance and Enforcement Actions Quarterly Review focuses on the latest enforcement and compliance trends that impacted consumer finance companies in the second half of 2023. Powered by our in-depth compliance monitoring and industry analysis, this review provides essential insights to help businesses navigate the evolving regulatory landscape effectively.

Access the full report (which includes the most notable marketing enforcement actions list) for free here.