Insights from Marketing Compliance Enforcement Actions in Q1 2024

Starting 2024 off strong, federal and state regulators were particularly active, finalizing 17 enforcement actions against consumer finance companies, totaling over $59 million in penalties and fees.

These actions highlight a few important trends: Misleading “free” and “instant” offers, discriminatory practices, dark patterns regarding subscriptions and cancellations, and FDIC insurance misrepresentation.

Here are the key marketing compliance and regulatory enforcement action insights to know from Q1 of 2024.

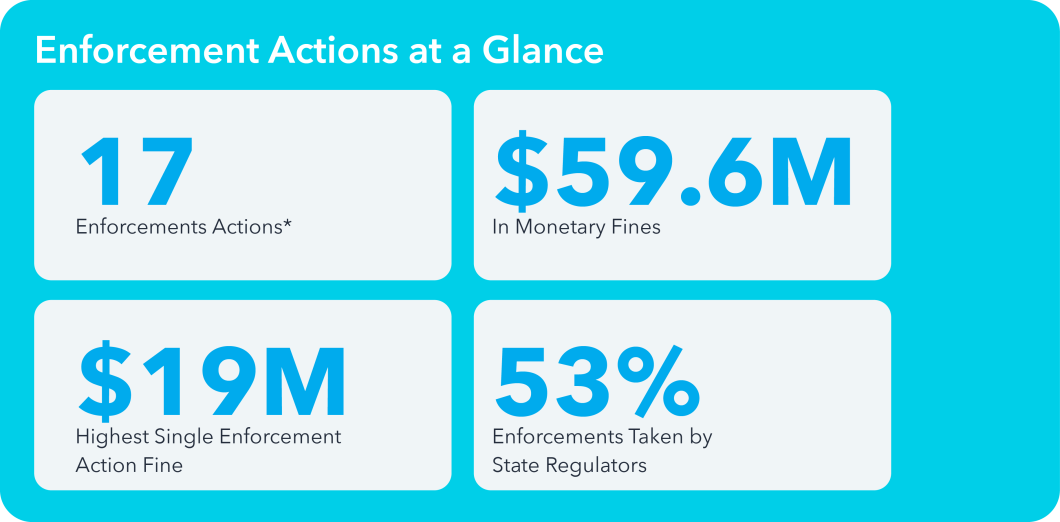

Enforcement Actions at a Glance

In the first quarter of 2024, federal and state regulators finalized 17 enforcement actions totaling over $59 million in monetary fines.

The highest monetary fine from a single enforcement action was $19 million, which was taken against a mortgage relief company in a joint effort by the Federal Trade Commission (FTC) and the California Department of Financial Protection and Innovation (DFPI) for violating the FTC Act, the Mortgage Assistance Relief Services Rule, the Telemarketing Sales Rule, the COVID-19 Consumer Protection Act, and the California Consumer Financial Protection Law.

While federal regulators—including the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), and the FTC—were busy, over half (53%) of these finalized enforcement actions came from state regulatory agencies—specifically Virginia, Florida, Massachusetts, Pennsylvania, Washington, Colorado, and North Carolina.

Key Enforcement Themes

Misleading “free” and “instant” offers

The FTC is a force to be reckoned with as a key enforcer of UDAAP. In the last three months alone, it has taken three separate enforcement actions against companies that made misleading “free” and “instant” offers.

The first enforcement action was against a fintech company for using empty promises of “quick” and “free” cash advances to entice consumers to join its service, only to fail to deliver the promised advance amounts—resulting in a hefty $3 million fine.

The next two actions were both against tax preparation companies for deceptively marketing their products as “free” when, in fact, these services were not free for most consumers.

The first company ran widespread advertisements promoting supposedly “free” products, which often repeatedly used the word “free” to mislead consumers into thinking they could file their taxes for free. However, the “free” service is not accessible to most taxpayers, including individuals receiving a 1099 form for gig economy work.

The second company ran a number of advertisements on TV and online, promoting that consumers can file for “free” with the company. The ads contain language saying—sometimes only in fine print—that the “free” offer applies only to “simple returns.” The ads, however, do not explain what a “simple return” is, and the company changed its definition of a “simple return” multiple times in recent years.

Discriminatory practices

Combating discriminatory practices was also a key theme in recent enforcement actions, ordering companies to create or improve their fair lending programs.

The same fintech mentioned above also discriminated against consumers receiving public assistance by excluding their income in eligibility assessments for advances while still charging them the monthly subscription fee, effectively barring them from accessing the advertised services.

In another enforcement action, which led to a total penalty amount of $13.5M, the Department of Justice (DOJ) and the North Carolina Attorney General took action against a national bank for engaging in lending discrimination by mortgage redlining predominantly Black and Hispanic neighborhoods in North Carolina.

The bank failed to provide mortgage lending services to these neighborhoods and discouraged people seeking credit in those communities from obtaining home loans. The bank relied on mortgage loan officers working out of predominantly white areas to generate loan applications and the bank did not track how its mortgage loan officers developed loan referrals or how they distributed the bank’s mortgage marketing materials.

Dark patterns related to subscriptions and cancellations

Dark patterns were another key enforcement focus for Q1, specifically for subscriptions and cancellations.

The same fintech company mentioned above was also hit for making the subscription cancellation “extremely difficult” through the use of dark patterns. The cancellation process was manual-only, delay-filled, error-ridden, and the system refused cancellation requests without actually informing the consumer of that decision.

Similarly, one of the tax preparation companies mentioned above pushed consumers towards more expensive products designed for complex tax filings and did not provide clear explanations regarding which products cover which forms, schedules, or tax situations, which caused many consumers to begin their tax returns in unnecessarily expensive products.

When these consumers later realized they didn’t need or want those expensive products, the company made it difficult for them to downgrade by imposing a series of time-consuming challenges. Its system would delete all the tax data consumers have entered, requiring them to start their tax return from scratch, creating a significant disincentive to downgrading. This stands in contrast to the upgrade process, where consumers’ data seamlessly moves to the more expensive product instantly.

FDIC insurance misrepresentation

Lastly, the FDIC has been increasingly focused on misleading advertisements related to deposit insurance, issuing a final rule (effective April 1, 2024) amending its advertising requirements for both insured institutions and non-banks who work with insured institutions, clarifying where and how to disclose FDIC insurance properly.

Specifically, the FDIC sent cease and desist letters to five entities for false and misleading statements and advertising related to FDIC insurance, including suggesting they are FDIC-insured, misusing the FDIC’s name or logo, misrepresenting the nature or extent of deposit insurance, and/or failing to clarify their relationship with insured depository institutions for customer deposits.

Get the full marketing compliance enforcement actions report

PerformLine’s Marketing Compliance and Enforcement Actions Quarterly Review provides the latest insights on enforcement and compliance trends impacting the industry. Powered by our compliance monitoring and analysis, this report helps businesses navigate the changing regulatory landscape.

Access the free report, including the full list of notable enforcement actions, here.