5 Marketing Compliance Trends to Know for Consumer Finance

Based on a recent survey, the State of Marketing Compliance Report provides valuable insights into how top banks and financial services companies perceive their programs’ performance and how they plan to navigate marketing compliance in the year ahead.

By understanding these trends, organizations can improve their compliance frameworks, ensuring that they can manage marketing compliance efficiently and maintain a competitive advantage in the ever-changing regulatory landscape.

Here are the 5 trends to know for marketing compliance this year.

Compliance teams are getting smaller, but are optimistic for the future

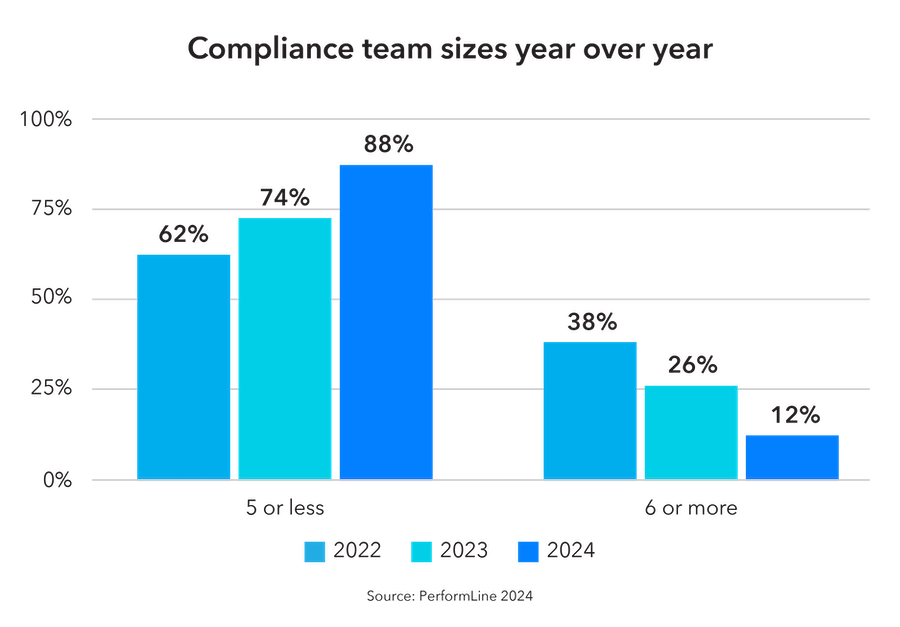

The majority of compliance teams are small, with 88% of respondents reporting having a team of 5 or fewer in 2024. And, compliance teams are getting smaller every year—this is compared to 74% in 2023 and 62% in 2022.

The continuous reduction in team size is most likely due to the challenging macroeconomic environment in 2023, with increased regulatory pressure, rising rates, and consumer stress contributing to the subsequent widespread layoffs in the industry.

But, it’s not all bad. The predominance of smaller teams could also suggest a focus on efficiency or a dependence on streamlined processes and technology to manage compliance.

The good news is that most respondents (76%) expect their teams to stay the same or grow in 2024, with only 3% anticipating a reduction.

Whether smaller teams are a result of a down market or an initiative to become more efficient, marketing compliance technology can help organizations “do more with less” by providing comprehensive compliance coverage without additional headcount.

Manual processes and resource constraints are top challenges

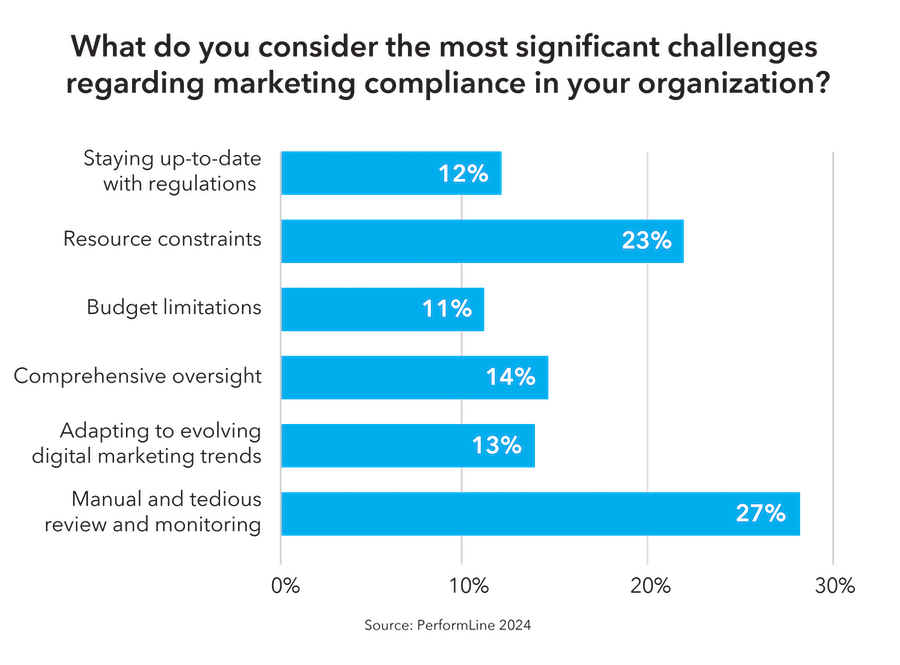

The most significant marketing compliance challenges for consumer finance organizations are manual and tedious review and monitoring processes and resource constraints, accounting for 50% of responses.

Manual review and monitoring processes require significant time and effort, often leading to delays and errors in compliance. Resource constraints, such as a lack of staff, can also limit these organizations’ ability to implement effective compliance programs and processes.

Other notable challenges mentioned in the survey include comprehensive oversight and adapting to evolving digital marketing trends. Ensuring comprehensive oversight over all marketing activities is critical to maintaining compliance, but it can be challenging—especially when dealing with large volumes of marketing materials and channels. And, with the increasing use of digital channels, organizations must also adapt to new marketing trends while ensuring compliance with various regulations.

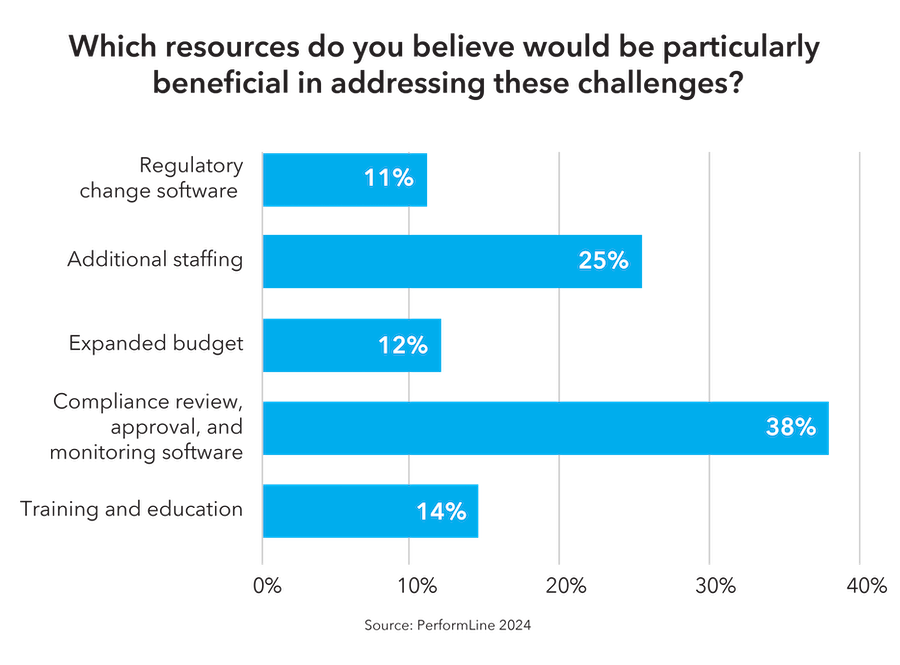

Respondents agreed that technology would be the most beneficial solution to address these challenges.

Specifically, automated compliance review and approval and monitoring software can significantly reduce the manual effort required for compliance, minimize errors, and increase efficiency.

Additionally, 25% of respondents reported that additional staffing could help address the challenges faced by consumer finance organizations, providing more resources to implement effective compliance programs and processes.

PerformLine’s omni-channel compliance software includes automated reviews and approvals and ongoing monitoring of content across marketing channels. This technology addresses the need for more efficiency and less manual oversight, and can also supplement limited resources, thereby helping organizations to stay ahead of evolving digital marketing trends and ensure comprehensive oversight.

Efficiency via technology is becoming essential

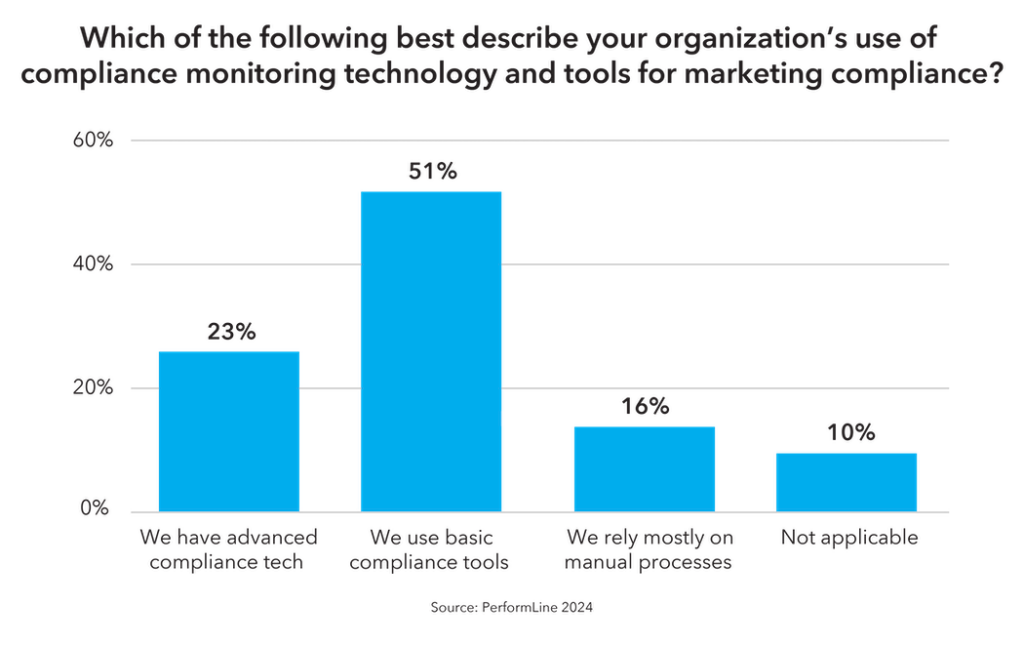

As organizations work to solve the challenges of limited resources, they’re increasingly relying on technology to streamline their compliance processes and management.

Notably, 74% of organizations have invested in compliance technology, indicating a shift towards more automated and efficient compliance strategies.

An effective marketing compliance software that can grow and scale alongside your business and adapt to the ever-changing regulatory and digital marketing landscape is critical.

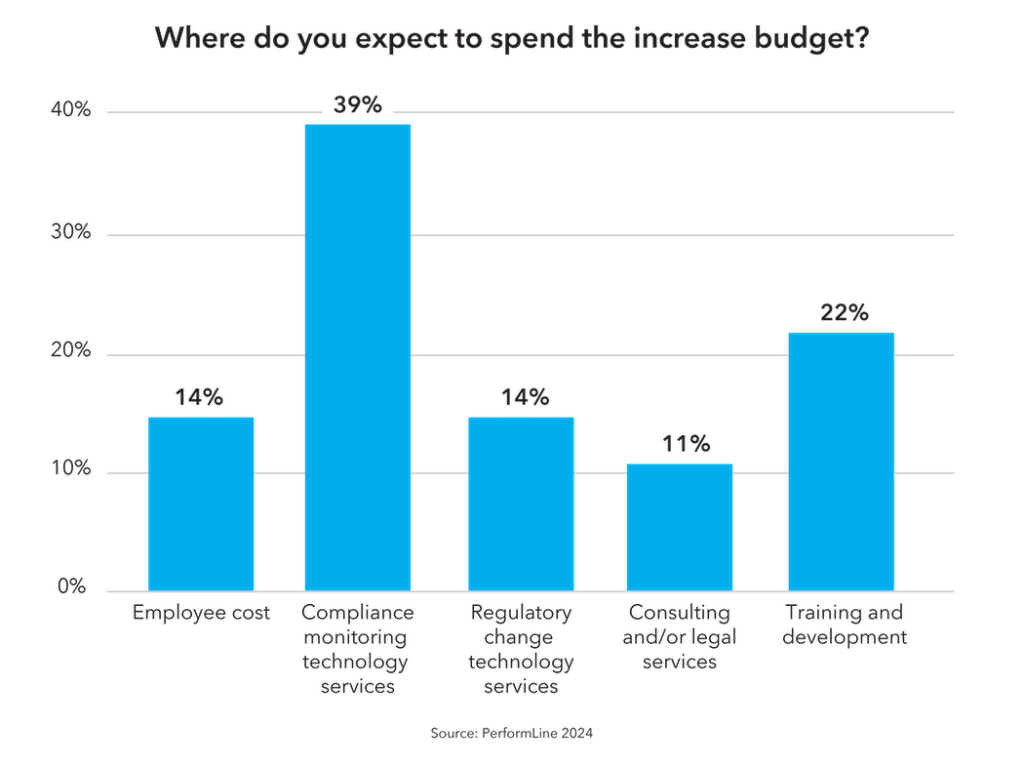

For those anticipating increased budgets, compliance monitoring technology services are the top area of increased spending (39%), followed by training and development (21%).

This shift in spending areas indicates a trend towards more technologically driven and skill-enhanced compliance strategies.

Businesses that invest in compliance monitoring technology see significant time savings and ROI. For example, PerformLine clients save over 1,200 hours each month with automation and technology—equivalent to the workload of 7 full-time employees.

Automated compliance programs are linked to increased confidence

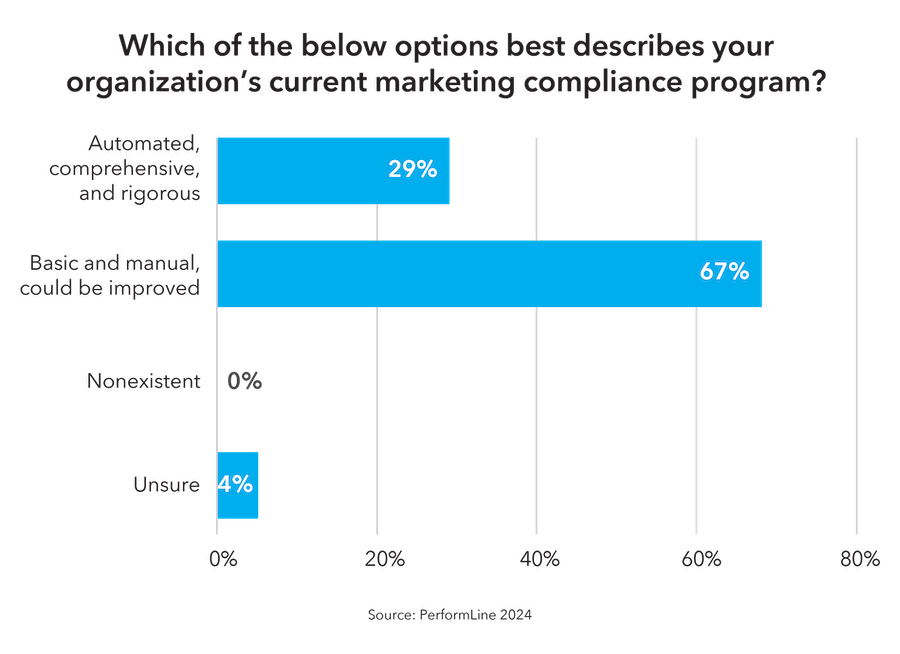

A significant majority (67%) of respondents describe their marketing compliance programs as “basic and manual, could be improved,” suggesting that while compliance programs are in place, these programs may not be fully developed or optimized.

The majority (61%) of respondents also have “moderate confidence” in their marketing compliance programs.

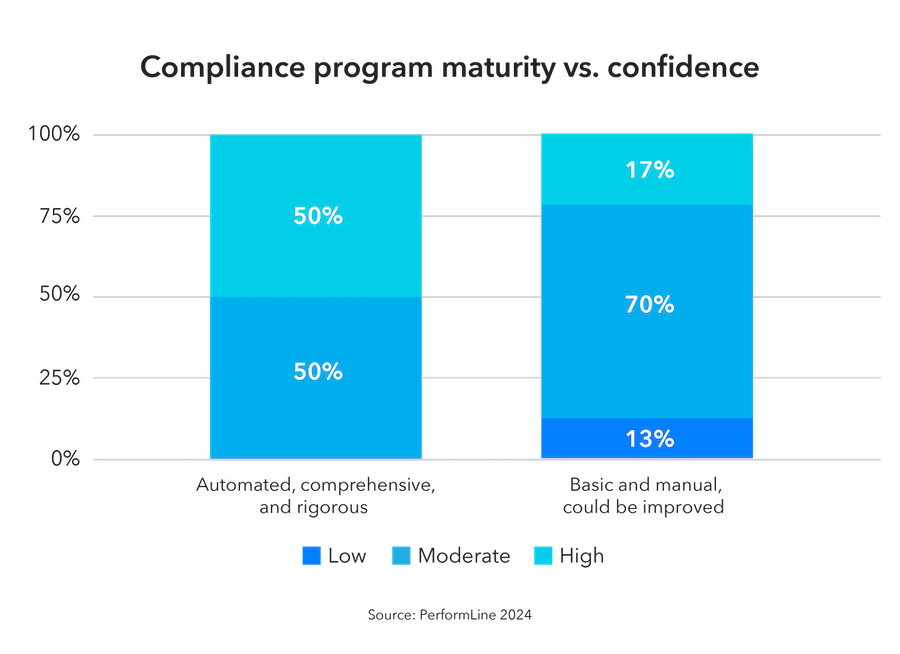

Organizations with mature, automated compliance programs exhibit higher confidence levels compared to those with basic, manual processes.

While confidence levels were evenly divided at 50/50 between moderate and high for respondents with automated and comprehensive compliance programs, the average rating stood at 8.4, indicating an overall high level of confidence.

In contrast, for those with basic and manual compliance programs, a majority of respondents (70%) expressed only moderate confidence in their programs, yielding an average rating of 7.3

Automation and technology—like PerformLine—can effectively increase compliance program effectiveness and thus, increase confidence in compliance programs.

Growing partnerships increase compliance complexity

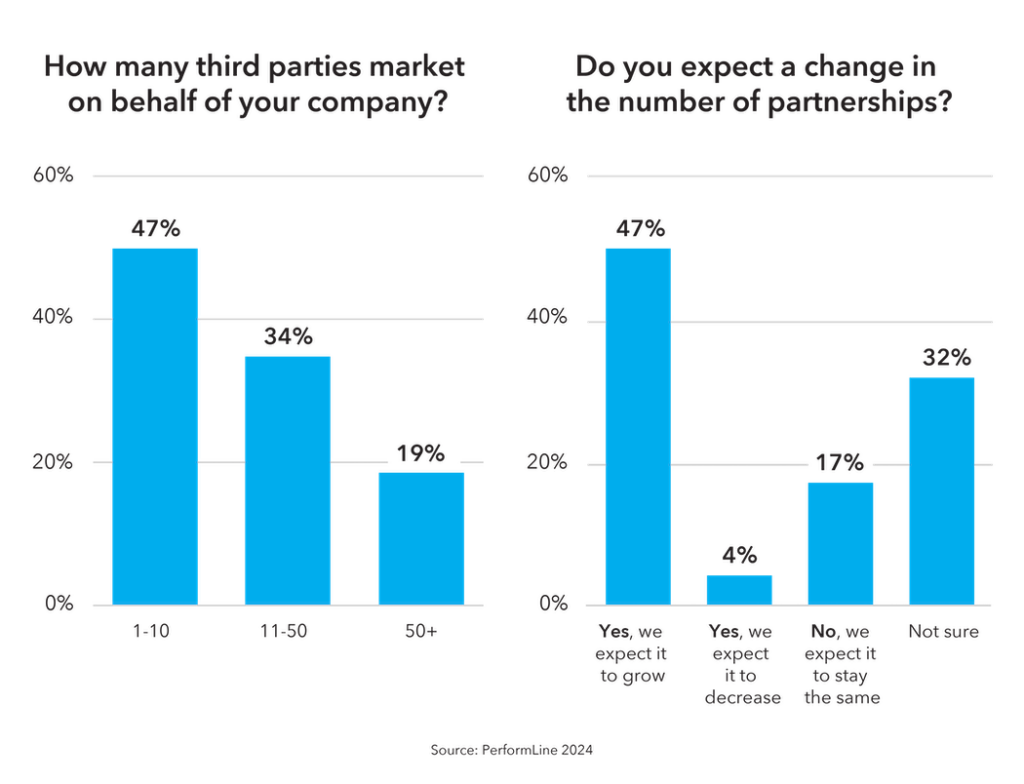

53% of respondents said they work with 11 or more partners, affiliates, or other third parties who market on their organization’s behalf, and 71% expect that number to remain the same or increase in 2024.

As organizations expand their partnerships, they extend their marketing reach and exponentially increase the risks and complexities associated with compliance.

With an increase in the number of marketing partnerships, organizations face the challenge of scaling their compliance efforts. This challenge is not just quantitative but also qualitative, addressing various compliance issues that might arise from different marketing activities and channels used by partners.

Get the full State of Marketing Compliance Report

For more in-depth insights on marketing compliance trends, challenges, and concerns, download a free copy of the 2024 State of Marketing Compliance Report here.