How Do the FTC and CFPB Use Consumer Complaint Data?

In our most recent edition of the Consumer Complaints Report, we took a deep dive into consumer complaint data collected by the Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB) to uncover key compliance trends in the financial services marketplace.

Consumer complaint data is valuable for any financial institution to use to optimize their compliance programs, but how do these federal agencies use this data for their own initiatives? Part 1 of this seven-part series will take a look at the FTC’s Sentinel Network, the CFPB’s Consumer Complaint Database, and how this data is utilized.

Download our Complaint Risk Signal Report to learn the trends that could signal compliance risks for your organization

The FTC’s Sentinel Network

Each year, millions of consumer complaints are collected by the FTC in their Consumer Sentinel Database-a secure online database-from a number of contributing entities, including the CFPB. Complaint topics vary from fraud and identity theft, scams created intentionally to deceive consumers, and any unfair or deceptive practices by financial institutions.

The FTC collects data from a large list of other federal, state, local, and international law enforcement agencies, as well as other organizations, like the Better Business Bureau and Publishers Clearing House-providing a big picture of the issues that consumers are facing.

Previously, the database was only available to law enforcement agencies, but in 2018, the FTC started making consumer complaint information accessible to the public in the form of interactive dashboards that “let you spot trends and find out about top reports in your state and around the country.”

The FTC, specifically its Bureau of Consumer Protection, collects consumer complaints to conduct investigations, sue companies and individuals who break the law, develop rules to maintain a fair marketplace, and educate consumers and businesses about their rights and responsibilities.

As of Q3 2020, there are over 2.1 million financial services-related complaints in the FTC’s Sentinel Network (including complaints submitted against credit bureaus, banks and lenders, debt collectors, and their subcategories).

The CFPB’s Consumer Complaint Database

The CFPB’s Consumer Complaint Database is a collection of complaints about consumer financial products and services that the Bureau sent to companies for response. Complaints are published in the database after the company responds, confirming a commercial relationship with the consumer, or after 15 days, whichever comes first.

The CFPB regulates the offering and provision of consumer financial products or services under the federal consumer financial laws and analyzes complaint data through various lenses to understand the situations consumers encounter collectively in the financial marketplace.

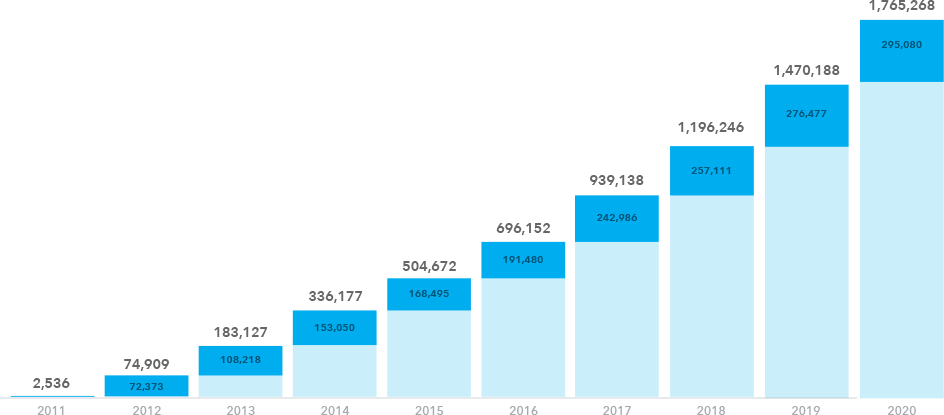

As of Q3 2020, there are over 1.7 million complaints in the CFPB’s database. The number of complaints in the database has increased by an average of 22% year-to-year since 2012 (the Bureau’s first full year of accepting complaints).

The CFPB Consumer Complaint Process

Here’s a quick look at how the Bureau handles complaints submitted by consumers:

If the Bureau begins to see a pattern of non-responsiveness from a company, a company not providing the relief consumers are entitled to, or a company that appears to be using unfair and deceptive practices, the CFPB would launch an investigation into those situations. Companies with poor responses-both in quality and in quantity-as well as companies whose practices were found to be disingenuous or misleading, risk being fined or facing an exam-focused enforcement action on that specific issue.

“When I was at the CFPB, complaints factored heavily into the enforcement actions that we brought.”

Chris D‘Angelo, former CFPB Associate Director of Supervision, on a panel discussion at COMPLY