COVID-19, Consumer Complaints, and Financial Institutions [Data]

As the pandemic continues, financial institutions find themselves facing unprecedented challenges, such as handling escalating call volumes and requests, keeping up with and complying with new regulations and guidelines (such as the CARES Act), and managing and monitoring a remote workforce. COVID-19 has taken its toll on consumers as well, with the Consumer Financial Protection Bureau (CFPB) experiencing record-high consumer complaint counts due to the pandemic.

In our Consumer Complaints Report, we analyzed the consumer complaint data from the CFPB, FTC, and the PerformLine platform to explore the biggest challenges that consumers are facing, and how financial institutions can use this information to improve both their regulatory compliance and customer service efforts.

FTC Complaints

There are over 24,000 COVID-related complaints in the FTC’s Sentinel Network (for financial services categories, as of Q3 2020). Credit cards have the highest amount of COVID-related complaints, accounting for 32% of all financial-services related complaints, followed by:

- Credit bureaus (25%)

- Banks and lenders (25%)

- Mortgages (18%)

CFPB Complaints

Credit reporting and debt collection continue to dominate the COVID-related consumer complaint totals so far this year (we’ll touch more on this trend in another part of this series, stay tuned).

COVID-19 COMPLAINTS BY CATEGORY

At the start of the pandemic, credit cards saw the largest initial spike in consumer complaints-a 36% increase from March to April, followed by savings accounts (32% increase) and mortgages (14% increase) in the same time frame.

But, behind credit reporting and debt collection, mortgages have consistently been the third most-complained about product regarding COVID-19 (with the exception of May, where credit cards slightly outnumbered mortgages).

For more in-depth information around mortgage complaints, download the report now and keep an eye out for the next blog in this series.

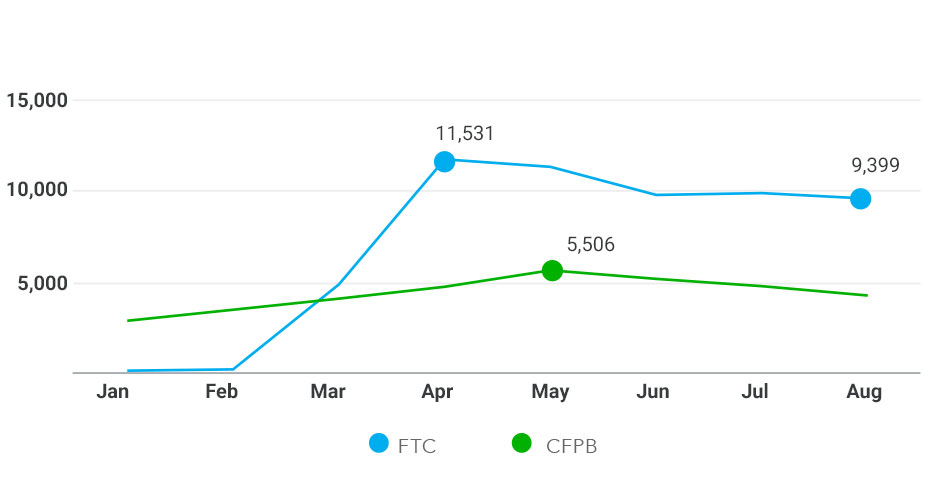

COVID-19 Complaint Counts by Month

Total COVID complaints submitted to the FTC peaked in April, totaling 11,531. Monthly complaint counts have decreased slightly since then, about 22% lower in August with 9,399 complaints.

The total COVID complaints submitted to the CFPB spiked in May, which likely could be due to credit reporting-related complaints, which peaked at 2,642 during that month.

COVID-19 COMPLAINT COUNT BY MONTH

COVID-Related Calls: PerformLine Data

We took a look at the aggregate data from our call center monitoring related to our COVID-19 rulebooks to get insights on how many calls were related to the pandemic.

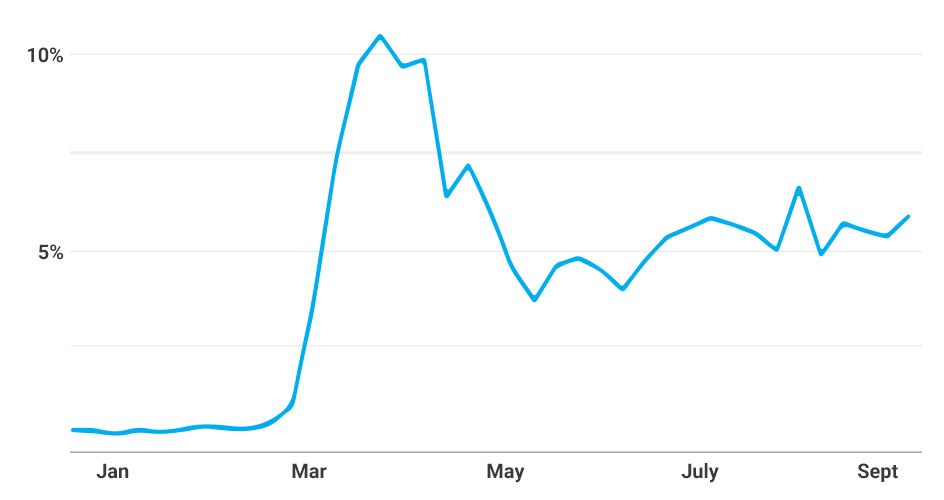

PERCENTAGE OF CALLS RELATED TO COVID-19

While this isn’t comprehensive data from all financial institutions, it sheds some light on the nature of call center volumes that financial service providers are facing. The peak in COVID-related calls correlates with the complaint volumes submitted to both the CFPB and FTC in March and April.

Many consumers were contacting their financial service providers for assistance during the crisis, with calls skyrocketing the week of March 29th, 2020. It’s possible that many call centers were not equipped with the resources to effectively manage the influx of calls and requests, and customers were not receiving the help they needed, which led them to submit complaints to the regulators.

The Pandemic Isn’t Over

Although complaints have been on a decline since April-May, financial institutions are starting to see an increase in coronavirus-related calls since September. As COVID cases are beginning to rise again and more states are considering options to mitigate further spread, it’s important that financial institutions are prepared for the potential influx of requests from consumers to help provide the relief they need and to protect themselves from regulatory compliance risks.

PerformLine offers a suite of tools to help companies manage COVID-related issues linked to their brands, including brand offenses and regulatory requirements, like Regulation X’s loss mitigation requirements. Speak to one of our experts today to learn more.

For more insights on consumer complaints, download the full, free Consumer Complaints Report and check out the rest of this blog series.