How to Be Prepared to Comply with the CFPB’s $8 Late Fee Rule

In its continued efforts to reduce “junk fees,” the Consumer Financial Protection Bureau (CFPB) banned excessive late fees on credit cards by capping them to $8, a significant reduction from the current average of $32.

For banks with over 1 million credit card users, this change means reviewing and updating all communication materials—including marketing collateral and required disclosures—to represent this new late fee policy accurately.

While the rule is currently facing legal challenges, banks are encouraged to be proactive in complying and identifying places where late fees need updates. As it stands, the rule is set to take effect on May 14th.

Is your organization ready to make these changes quickly? PerformLine’s automated technology can help you ensure compliance and stay ahead of the game.

Where to update late fee disclosures

To comply with the new rule, anywhere late fees are mentioned in relation to your credit card offerings must be updated to reflect the new $8 threshold, including:

- Schumer boxes on your company’s website and printed card agreements

- Marketing materials, including printed and digital advertisements, brochures, social media posts, marketing emails, etc.

- Credit card comparison sites and other publisher sites

- Third-party affiliates or partners who market your card offers to consumers

Identify outdated late fees at scale with PerformLine

With PerformLine, you can automate and streamline the discovery and monitoring of late fees across all of your communication channels to ensure compliance with the $8 cap and make those updates quickly.

⚙️

How does it work? PerformLine’s automated monitoring technology will look for late fee disclosures across marketing materials, Schumer boxes, and other communication mediums. If any outdated fees are found across a company’s website, affiliates, partners, or other previously unknown placements, your team will be alerted. Now, instead of spending countless hours manually looking for content, you can spend your time taking action on the content that has yet to be updated. More coverage, less frustration.

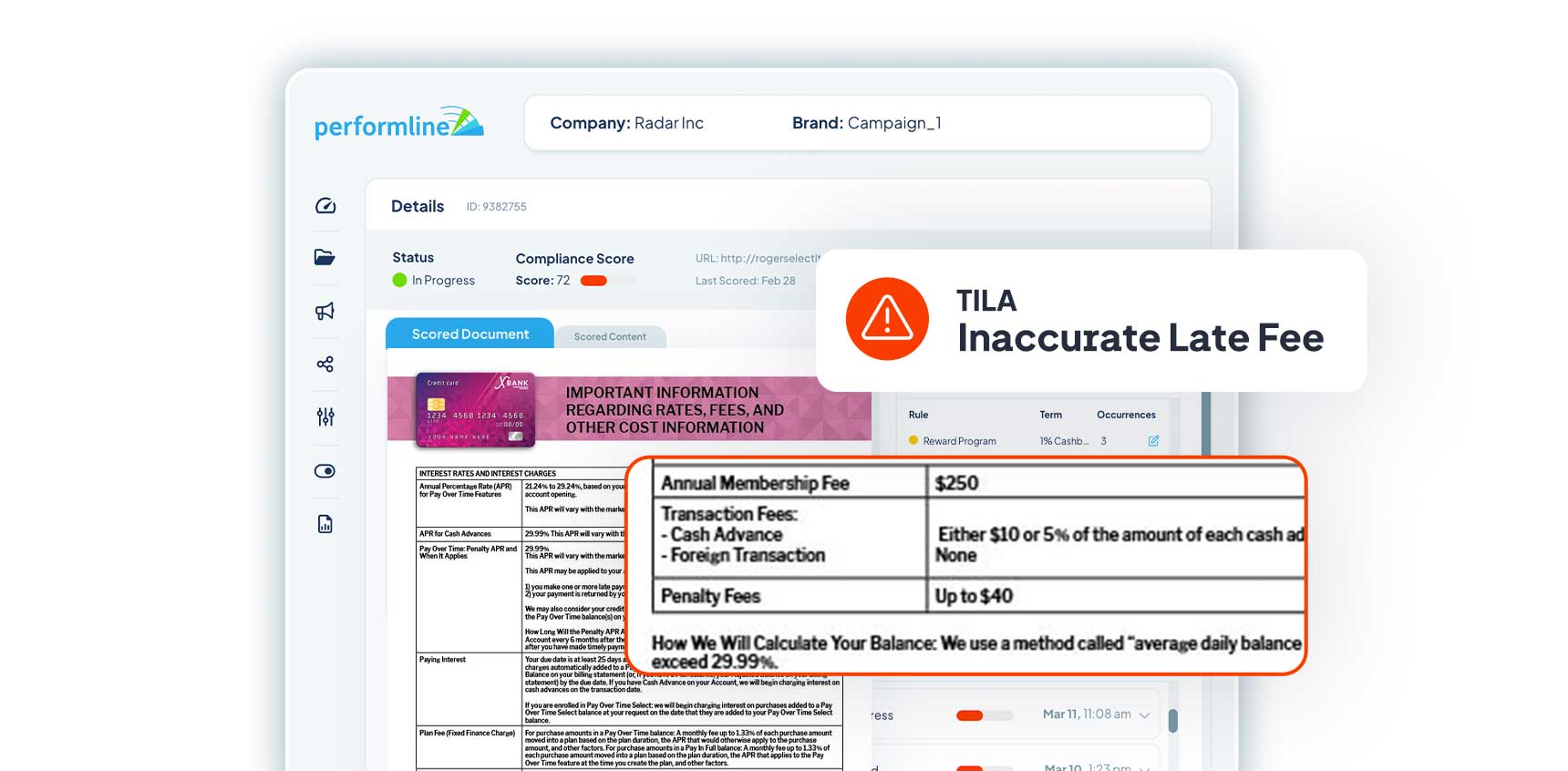

Instantly review and get feedback on documents before they’re live

Our platform automates the compliance review process for all types of materials before they’re published, including marketing materials, cardholder agreements, Schumer boxes, and other disclosure documents. Once a document is submitted to the platform, you’ll receive instant feedback on content and will be notified of any outdated late fees that need to be updated.

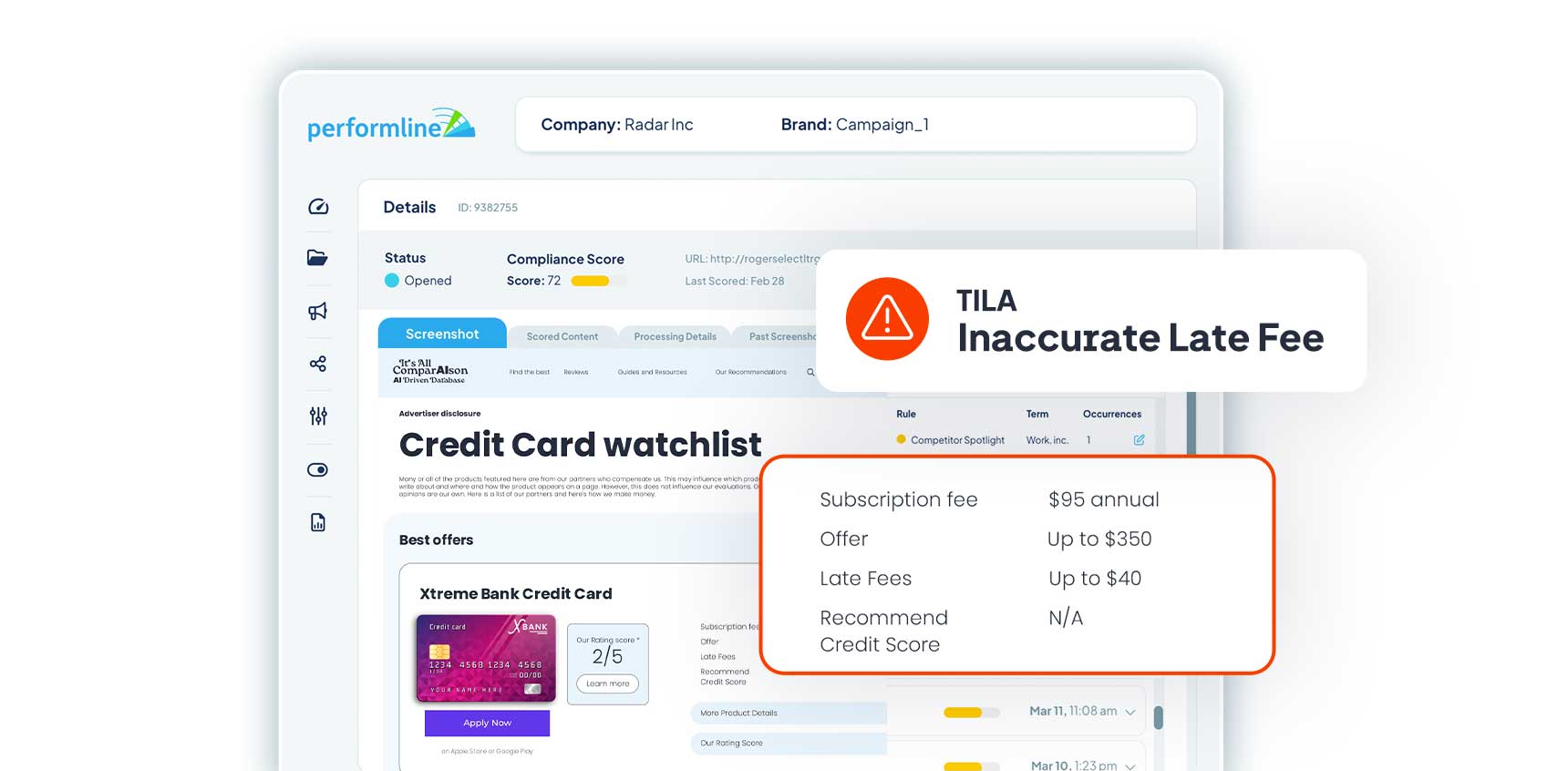

Discover and monitor late fees across the web, social media, and marketing emails

Not only does PerformLine monitor all of your known content, but also discovers any unknown brand promotions across web pages, social media posts, affiliates, and partners, and can identify any outdated late fees associated with those promotions. Once any outdated late fees are identified, you’ll receive a notification within the platform to review and remediate the issue.

Ensure reps are adhering to new requirements in calls and messages

PerformLine also offers tools to monitor every minute of call recordings and every message exchanged to ensure that reps adhere to the new rule in all communications with consumers. These instances will be flagged for each rep so you can coach appropriately.

Monitor late fee disclosures with PerformLine

How is your team ensuring that your content is up-to-date and accurate across channels, platforms, and third parties?

Let PerformLine help. Schedule some time with our team to learn more.