State Regulators Are Stepping Up Consumer Protection Efforts. Here’s What That Means for Compliance.

In 2025, state regulators are significantly expanding their role in consumer protection. As federal agencies like the Consumer Financial Protection Bureau (CFPB) scale back enforcement in certain areas, state authorities are stepping in with greater rigor.

They’re establishing new regulations, enhancing enforcement, and implementing consumer protection initiatives that often exceed federal standards. For organizations, this shift means navigating an increasingly complex and fragmented landscape of state-level regulations.

Here’s how state regulators are intensifying their focus on consumer protection, what this means for compliance, and how PerformLine can help organizations manage multi-state compliance requirements.

Federal vs state-level priorities and enforcement actions

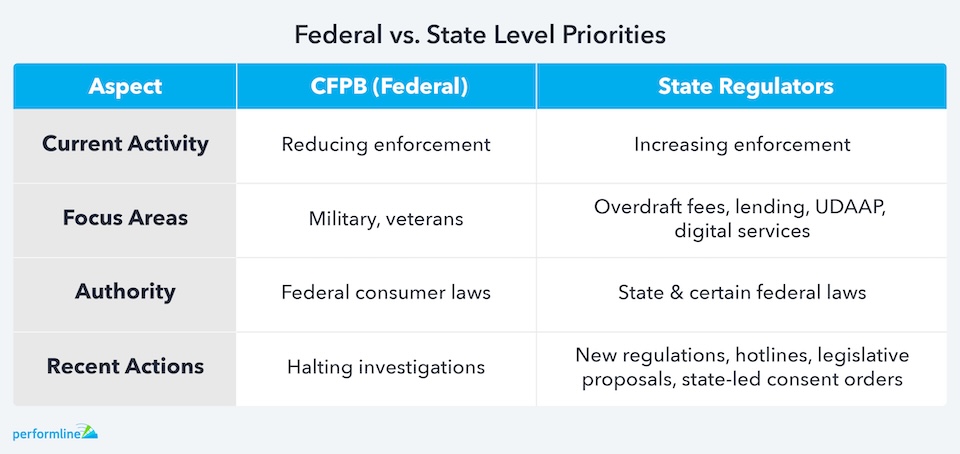

A clear divide has emerged between federal and state regulatory priorities in 2025.

While federal agencies—particularly the CFPB—are scaling back their enforcement efforts, state regulators are taking a more aggressive stance, actively developing and enforcing their own consumer protection rules.

Here’s what stands out from the data:

- State regulator dominance: So far in 2025, state regulators have accounted for 78% of all consumer protection-related enforcement actions, imposing $1.8B in monetary penalties.

- Watch out for private litigation: Over half (58%) of federal enforcement actions came from private litigation, such as class action lawsuits. Even without active federal agency action, companies remain at risk.

But beyond private litigation, it’s state regulators who are actively filling the gaps left by reduced federal oversight and driving the majority of enforcement actions in 2025.

How states are filling in the consumer protection gaps

Across the United States, several states have taken bold steps to enhance consumer protection:

Michigan Attorney General reaffirms commitment to consumer protection

Michigan has doubled down on its commitment to consumer protection, with Attorney General Dana Nessel emphasizing the importance of state-level enforcement in a landscape of shifting federal oversight. As federal agencies scale back, Nessel highlighted her office’s proactive approach to safeguarding Michigan consumers. This includes targeting fraudulent business practices, promoting fairness across industries, and taking enforcement actions against companies that deceive or harm residents.

New York DFS targets junk fees while broader consumer protections take effect

The New York Department of Financial Services (DFS) has introduced proposed regulations aimed at curbing unfair overdraft and non-sufficient funds (NSF) fees. These rules would set limits on fees, ban certain abusive practices, and require clear disclosures. “New Yorkers deserve fair financial practices, and these rules ensure that,” said DFS Superintendent Adrienne A. Harris.

These proposed rules align with broader consumer protection reforms that were recently enacted through New York’s FY2026 budget. The budget introduces new requirements for subscription cancellations, return policy transparency, and personalized pricing. It also brings Buy Now, Pay Later (BNPL) providers under regulatory oversight for the first time as federal BNPL regulations are being pulled back.

Pennsylvania launches centralized consumer protection hotline

Pennsylvania Governor Josh Shapiro has launched a new centralized consumer protection hotline, simplifying the process for residents to report violations. Alongside this, Pennsylvania is expanding its use of Dodd-Frank enforcement authority, allowing state regulators to pursue federal consumer protection violations when federal agencies fail to act. This expansion covers a wide range of issues, including predatory lending, student loan servicing problems, insurance fraud, and deceptive practices.

We won’t let federal cutbacks stop us from protecting our citizens.

– Governor Josh Shapiro

California prioritizes consumer protection with new legislation and state-led enforcement action

California has taken two notable actions to bolster state-level consumer protection. First, new legislation has been introduced to ensure companies comply with state consumer laws, even if federal standards are relaxed. This legislation aims to address gaps in oversight, particularly in digital financial services, where evolving business models often outpace existing regulations.

In a separate action, the California Department of Financial Protection and Innovation (DFPI) issued a state-led consent order against a bank—a rare move executed without federal agency involvement. This enforcement action is particularly notable within the banking-as-a-service (BaaS) sector, where most enforcement efforts have been joint initiatives between state and federal regulators.

By acting alone, the DFPI has signaled a potential shift toward more independent state oversight in consumer protection.

Washington State Supreme Court expands scope of email compliance

The Washington State Supreme Court has broadened the scope of the state’s Commercial Electronic Mail Act (CEMA), ruling that any false or misleading information in an email’s subject line violates the law, regardless of the message’s commercial nature. Violators may face fines of $500 per email, presenting substantial risks for marketers targeting Washington residents.

Idaho zeroing in on marketing compliance

Idaho regulators are significantly increasing their focus on marketing compliance, signaling a more rigorous examination process than in previous years. During recent examinations—highlighted in discussions at a recent COMPLY Mortgage Roundtable, hosted by PerformLine—regulators demonstrated an exceptional level of detail, scrutinizing not only marketing content but also the broader language and implications used in promotional materials.

According to industry feedback, “they let nothing go.” They’re referencing federal standards deeply and thoroughly, expanding their scope beyond what many institutions have traditionally prepared for.

This sharp uptick in enforcement intensity may represent just the beginning. With Idaho examiners reportedly in conversation with other state regulators, there is growing concern about a potential trickle-down effect where similar scrutiny could soon emerge in other jurisdictions.

Maryland introduces EWA licensing law to strengthen compliance and consumer protections

Maryland has enacted a new law requiring Earned Wage Access (EWA) providers to be licensed under the state’s Consumer Loan Law. Aimed at addressing compliance gaps and protecting consumers, the law applies to both employer-based and direct-to-consumer models. It mandates at least one free access option, caps expedited delivery fees, prohibits interest charges and credit checks, and requires clear fee disclosures. Providers must also allow penalty-free cancellations and reimburse overdraft fees caused by failed repayments unless fraud is involved.

What this means for compliance

For organizations operating in consumer financial services, the shift toward state-driven enforcement has significant implications. Simply maintaining compliance with federal standards is no longer sufficient.

Organizations have to monitor and comply with a growing array of state regulations, which can vary substantially across jurisdictions.

To remain compliant, organizations need a proactive, scalable approach.

Reliance on manual processes for tracking and managing state regulations is inefficient and prone to errors. Instead, a technology-driven solution is essential for maintaining compliance across multiple states.

How PerformLine simplifies multi-state compliance

PerformLine’s automated compliance platform is designed to take the headache out of multi-state compliance with:

- Automated monitoring across channels: PerformLine monitors your marketing, communications, and customer interactions across digital channels for potential compliance issues.

- Real-time alerts: Get daily notifications when we detect a potential violation, so you can address it before it escalates.

- Custom rulebooks for each state: Our platform can apply state-specific rules to your content, ensuring you’re always compliant with local regulations.

- Centralized documentation: Keep all your compliance records in one place, making it easy to demonstrate your compliance efforts to regulators.

- Scalable compliance: Whether you’re dealing with one state or all fifty, PerformLine’s platform grows with you.

Leading companies already trust PerformLine to protect their brands and stay ahead of changing regulations. Want to see how it works?

Schedule a demo of the platform.