Monitoring Consumer Complaints Makes For A Better Compliance Program

Consumer concerns should be at the forefront of any business initiatives, especially for those in financial services. With strong consumer protection laws put in place by regulators, financial institutions are under heavy scrutiny. Consumers are encouraged by these agencies to submit their complaints regarding issues with companies in order for the regulators to get a better idea of where they should be placing their focus. Consumer complaints are more important than you might think when it comes to avoiding regulatory enforcements and protecting your brand’s reputation.

What Do Regulators Do With Consumer Complaints?

Regulators like the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), State AGs and more collect consumer complaints and analyze them to identify industry trends, work to eliminate unfair business practices, and help guide their enforcement actions.

When I was at the CFPB, complaints factored heavily into the enforcement actions that we brought. Often times if we have an area of concern, it’s the entity where we’re receiving the most complaints that we look to first to see if that concern has merit, and they’re the ones that are going to be at the receiving end [of enforcement actions].

—Chris D’Angelo, former Associate Director of Supervision, Enforcement and Fair Lending, at the CFPB; current Chief Deputy Attorney General for Economic Justice at the Office of the New York State Attorney General

I can’t stress enough about treating complaints seriously. We’re constantly looking at what are our top number of complaints, what type of complaints are there, who’s complaining, what the issues is.

—Paul Rodriguez, Acting Director, Division of Consumer Affairs at New Jersey Attorney General’s Office

Benefits of Monitoring Your Company’s Complaints

Avoid Regulatory Enforcement Actions

Being aware of how many consumer complaints your company is receiving, as well as what they are about, will help you be proactive in your compliance program. You’ll be able to identify potential compliance issues before they become a reality and adjust your processes and procedures to prevent them from happening at all. When done correctly, this can lead to a decrease in consumer complaints about your company and, in turn, reduce your risk of being targeted by regulators.

Create Better Business Processes

Taking a look at the bigger picture on both a company-wide and industry-wide basis allows you to identify the root cause of any issues and identify other lapses in your existing compliance program. With this, you can adjust your processes to accommodate for those and become overall more efficient.

If I were in your shoes, I would have a triage of anything that comes in from a regulator or consumer law enforcement agency. See what they’re complaining about and try to be proactive about what you’re seeing.

—Chris D’Angelo

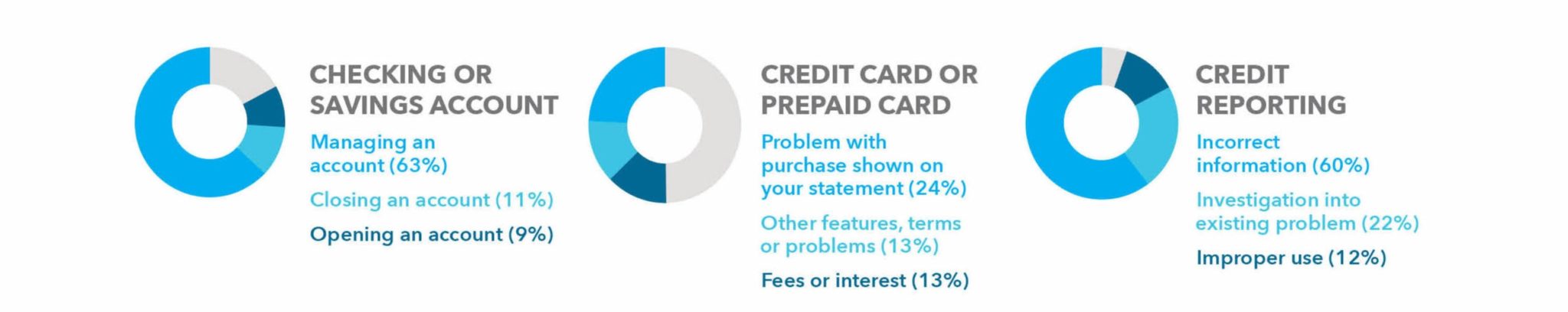

More often than not, most of your company’s complaints can be bucketed down into a small number of common issues. This holds true at an industry-wide level as well. In fact, when looking at top issues by product from the CFPB’s Consumer Complaint Database in 2018, the top 3 complaint issues per product account for at least 50% of that product’s total complaints.

Top Issues Per Product

Better Your Customer Service Function

Investigate to find out if consumer complaints submitted to regulatory agencies were submitted to your company first, but never received a response. If this is true, it can indicate a faulty customer service function.

By the time someone makes a complaint to us, it’s because they’re running into a brick wall at your company. Many times people come to us and they are frustrated, fed up, or not getting answers from your company. The customer service functions that you have are one of the most important that you have.

—Paul Rodriguez, Director of the NJ Division of Consumer Affairs

Maybe the issue is that your customer service team simply isn’t equipped with the correct resources to handle and respond to complaints. Maybe it’s just one or a few of your agents who are underperforming and aren’t serving customers well. Or, perhaps your agents aren’t able to meet your performance measures to gain incentives and are “gaming the system” in ways that are going to have adverse consequences for your consumers and your legal obligations.

Whatever the case may be, being tuned in to your internal complaint systems can help your compliance team get a handle on where there might be problems within the organization and remediate them for a better overall customer service function.

Learn From Competitors’ Mistakes

Don’t wait until you get caught up in an enforcement action to learn how to better comply with regulations. Monitor the activity of your competitors and see what kind of trouble they’ve run into, and use that to your advantage to better your own compliance function.

I think it’s common sense that you would look to see where other companies or entities that are engaged in the same practices you’re engaged in might have fallen short of their legal obligations to try to make sure you build that into your compliance structure.

—Chris D’Angelo

The database is especially valuable to compliance officers, as the data provided gives them a window into what’s going on at other companies in their whole industry, as opposed to just hearing what their own customers are saying.

—Richard Cordray, former Director of the CFPB

Protect Your Reputation and Gain Consumers’ Trust

Equifax, Facebook, AT&T…

If you’ve been paying attention to the news, you know that these companies have gotten into trouble with the regulators recently.

How do you view these companies now vs. before they got hit with these big fines and penalties? Suddenly you might have a hard time trusting them, and you might not feel safe using them. Sure, companies can fix these issues and pay their fines, but the reputational damage is already done.

Monitoring consumer complaints is a key function of any strong compliance management system to get out in front of enforcement actions and mitigate your risk, helping to protect your brand’s reputation and safety.