Financial Institutions, Social Media, and Compliance [Stats + Guide]

![Financial Institutions, Social Media, and Compliance [Stats + Guide]](https://performline.com/wp-content/uploads/2023/01/blog-featuredimage-financial-institutions-social-media-compliance.png)

Social media is a powerful marketing tool for financial services marketers, with the potential to reach billions of consumers across the globe. However, just like any other communication channel, posts on social media are subject to regulatory scrutiny. Understanding regulatory obligations and crafting a robust social media compliance program is critical for success.

A Marketing Staple

Social media is one of the fastest-growing marketing channels used today and should be a staple in your marketing strategy. Here’s why:

- The financial services sector has seen a 31% average year-on-year growth on social media (Agora Pulse)

- 42% of people use social media to research more information about a brand (GlobalWebIndex)

- Users are spending an average of 2 hours and 24 minutes per day on social media (GlobalWebIndex)

- 62% of financial advisors have reported getting new clients through LinkedIn (Blue Fountain Media)

Compliance Risks

However, social media comes with risks, and ensuring compliance with applicable laws, regulations, and guidelines is crucial. Here are some insights on compliance trends on social media:

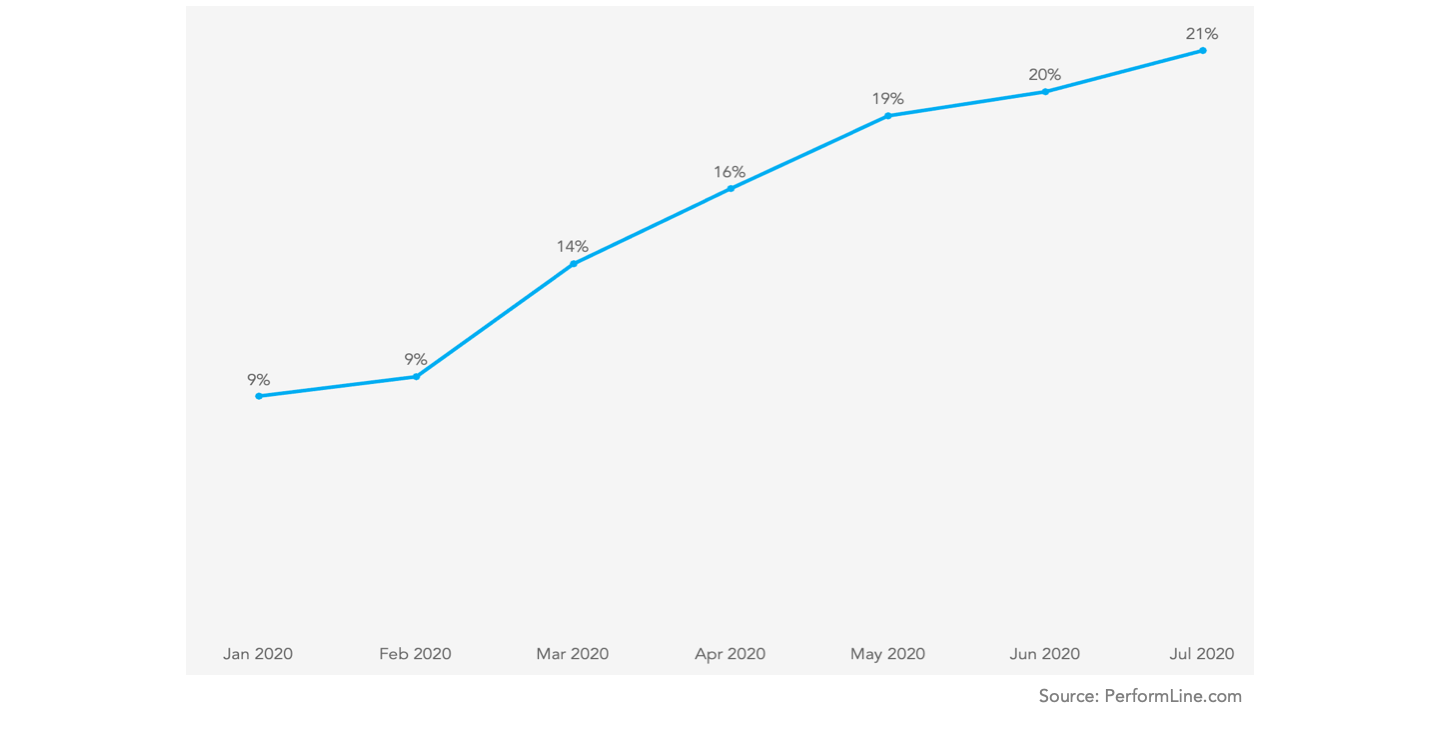

SOCIAL MEDIA POSTS WITH COMPLIANCE ISSUES

Across Twitter, Facebook, LinkedIn, Instagram, YouTube

21% of all monitored posts in July 2020 were flagged for compliance observations-an increase of 12% since January 2020

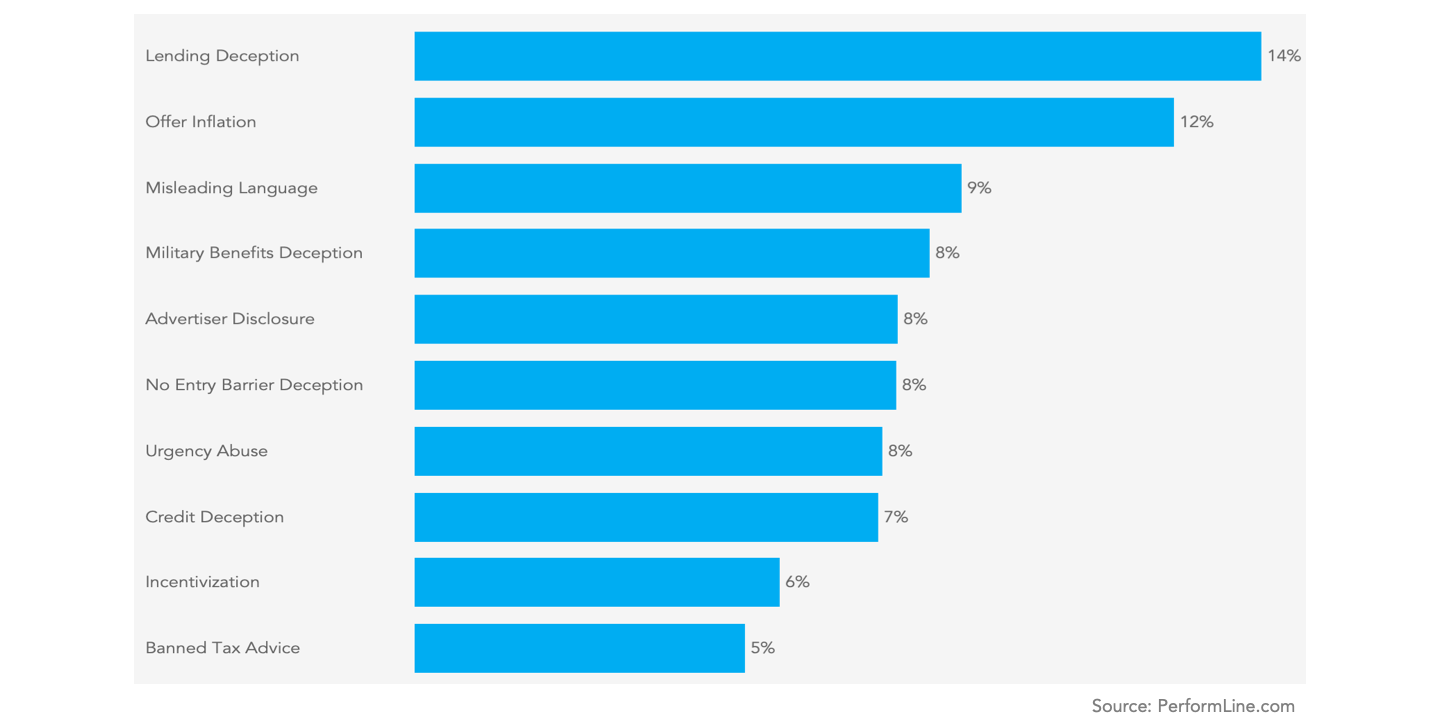

TOP COMPLIANCE ISSUES BY CATEGORY The top 5 compliance issues by category are: lending deception, offer inflation, misleading language, military benefits deception, and advertiser disclosure-collectively accounting for 51% of all issues found

The top 5 compliance issues by category are: lending deception, offer inflation, misleading language, military benefits deception, and advertiser disclosure-collectively accounting for 51% of all issues found

Regulatory Scrutiny

As social media becomes increasingly popular, regulators are placing heavier scrutiny on social media, especially for those in the financial services industry.

Financial institutions are expected to manage risks associated with all types of consumer and customer communications, no matter the medium.

—Federal Financial Institutions Examination Council (FFIEC)

Financial institutions are leveraging social media in many ways, including marketing, providing incentives, applications for new accounts, collecting and inviting feedback, receiving and responding to complaints, and providing loan pricing. Combined with the informal and dynamic communication on social channels, this can present unique compliance challenges and risks that must be proactively managed, monitored, and resolved.1

On top of this, institutions must ensure that they are adhering to the regulations governing social media (like Truth in Advertising, the FTC Act, Consumer Review Fairness Act, Rule 2210, UDAAP) and their industry-specific requirements.

Your Guide to Social Media Compliance

With all this complexity, how can financial service marketers ensure compliance while still reaping the benefits that social media marketing has to offer?

Check out the Ultimate Guide to Social Media Compliance for Consumer Finance, where we explore a wide range of topics surrounding social media compliance for financial institutions, including:

- Complying with regulatory requirements across social channels

- Six critical elements for a risk management program

- Advertisement and endorsement disclosure requirements

- Reputational risks and how to mitigate them

RESOURCES: