Fair Lending & Equity In The Housing Market

As the effects of the pandemic continue, many are still struggling to pay their rent and mortgages. With new moratoriums in place and a commitment to enforce equity and fairness by regulators, compliance and consumer protection must be top-of-mind for financial institutions.

2020 was an unprecedented year on so many levels, and its wrath seems to have carried over well into 2021. For many, we had hoped to see the end of the pandemic so that we could begin adjusting to our “new normal.” In some instances, it was the case. We all know of someone that has spread their wings to take a new job, or moved to a new state taking advantage of the new remote work offered to many. However, there are still many who are still struggling to find employment so they can pay rent or catch up on their mortgage payments to avoid eviction or foreclosure. For them, the pandemic has not ended and the struggle seems to worsen by the day.

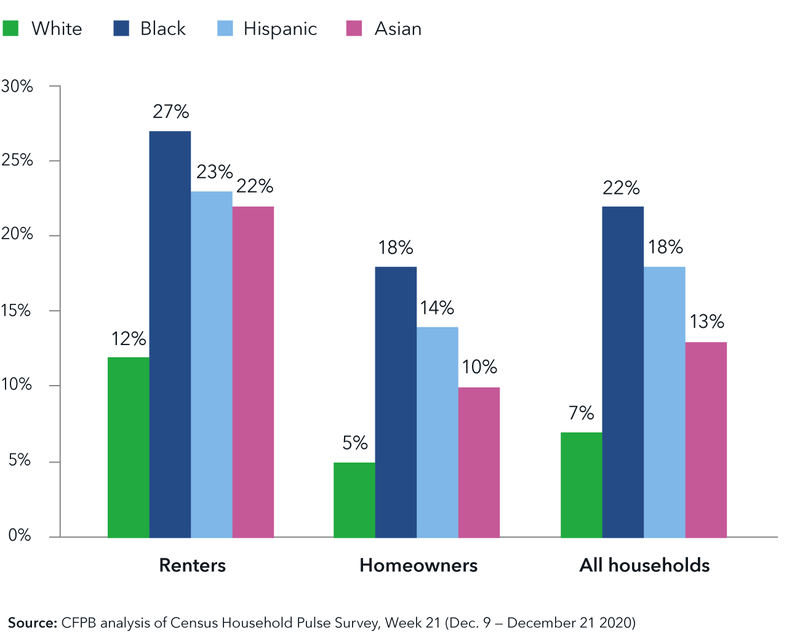

July 31, 2021 marked the ending of the federal moratorium on the eviction of tenants who fell behind on their rental payments during the course of the pandemic. This was a devastating blow to the many renters out there who may have suffered job losses, or the loss of a member of their household to COVID-19. Interestingly, there are $47 billion in federal funds out there through the Emergency Rental Assistance program-and, to date, only $3 billion of those funds have been used. The states seem to be struggling to disburse these funds leaving some landlords with little choice as to their next steps, which will likely result in busy landlord-tenant courts and the displacement of potentially millions of renters that remain behind on their payments. The majority of these are minority households and families with children residing in the home.

Share of households behind on housing payments by race/ethnicity and tenure, December 2020

On August 2, 2021, The Centers for Disease Control and Prevention (CDC) announced a new 60-day eviction moratorium geared to assist those counties that are designated as having a substantial or high transmission of COVID-19, which is defined as rates of 50 cases per 100,000 people over a seven-day period.

It is in times like this that we recognize how fragile our systems are and, as much as COVID-19 revealed to everyone the inequities faced by minorities, there were some signs that things were heading in the right direction and just maybe, for the first time, the playing field would begin to level a bit. Recently, the Consumer Financial Protection Bureau (CFPB) released their commitment to racial and economic equity where they outlined a push for fair housing and equity in lending for minorities and women. The commitment is definitely a step in the right direction, but it seems that we are far from out of the woods of the pandemic and its impact may run deeper and last longer than any of us would have imagined. I am not sure what it will take for those impacted to overcome this setback, but I do know that for those impacted, their American Dream may be a bit more distant than they had originally dreamed.

As this summer is quickly approaching its end and kids are preparing to return to school, I couldn’t help but think about how many of those kids would become residents of local shelters and how this pandemic continues to impact their ability to focus on their education. We have a generation of children that have had to deal with some real-world problems as they watch their families struggle to provide food and shelter. We always say that kids are resilient, however, I truly wonder what the impact will be on them and what it will take to get these families back on the right track. From my days in affordable housing development, I saw first-hand how hard it can be for families to recover from eviction. It often results in them having to live in worse conditions than they had previously lived in so that they can rebuild their credit and pay off their debt while hoping to find a landlord willing to take a chance on them.

The Bottom Line

The bottom line is that there are plenty of resources out there and as housing professionals, you should know that regardless if you are working with homeowners, renters, or landlords in need of assistance there are resources available, including from the CFPB who has a site dedicated with multiple resources. This is also a time where families are extremely vulnerable to housing discrimination. Should you come across anyone that describes what you believe to be a violation of the Fair Housing Act, they can file a complaint with HUD’s Office of Fair Housing Equal Opportunity.