Compliance Challenges For Mortgage Servicers During COVID-19 [Report]

In our Consumer Complaints Report, we took a deep dive into the mortgage-specific issues that consumers are facing due to the pandemic, what that means for regulatory compliance for mortgage companies, and how this information can be utilized to overcome the challenges they face.

Mortgage Forbearance and Regulation X

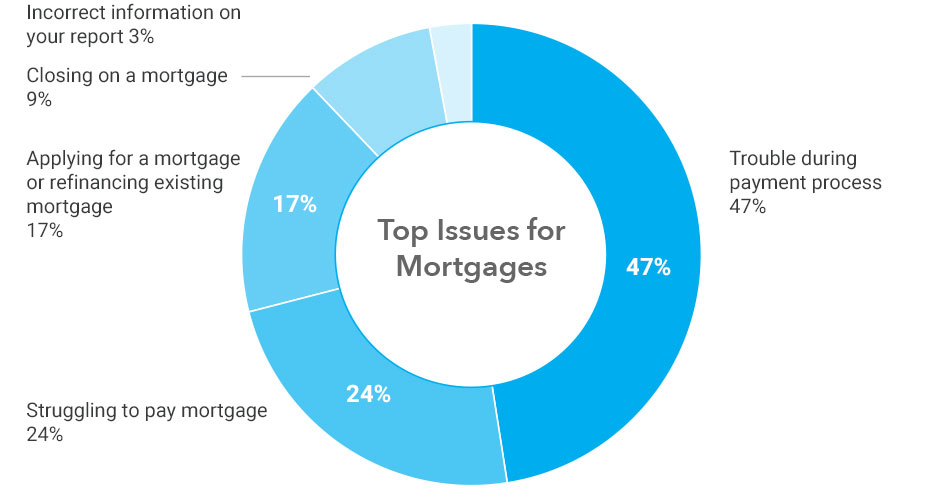

71% of COVID-related complaints against mortgage companies in the CFPB’s database are around 2 issues: people having trouble during the payment process and people struggling to pay their mortgage.

This comes as no surprise though since the CARES Act provides special provision for mortgage companies to provide forbearance for federally backed loans, and regulators have been encouraging the public to reach out directly to their lenders and servicers to request this assistance.

With unemployment claims surging (especially in the beginning of the pandemic), mortgage servicers have faced a huge increase of requests to their call centers from borrowers who are impacted. Many of these conversations likely qualify as loss mitigation applications and, even in this unprecedented time, mortgage servicers must be vigilant in respect to compliance with Regulation X’s loss mitigation requirements.

Since many organizations’ call centers were not prepared for this huge increase in call volume, many consumers may have been unable to get forbearance they need, leading to an increase in complaints submitted to regulators.

A Surge of Complaints In May – Why?

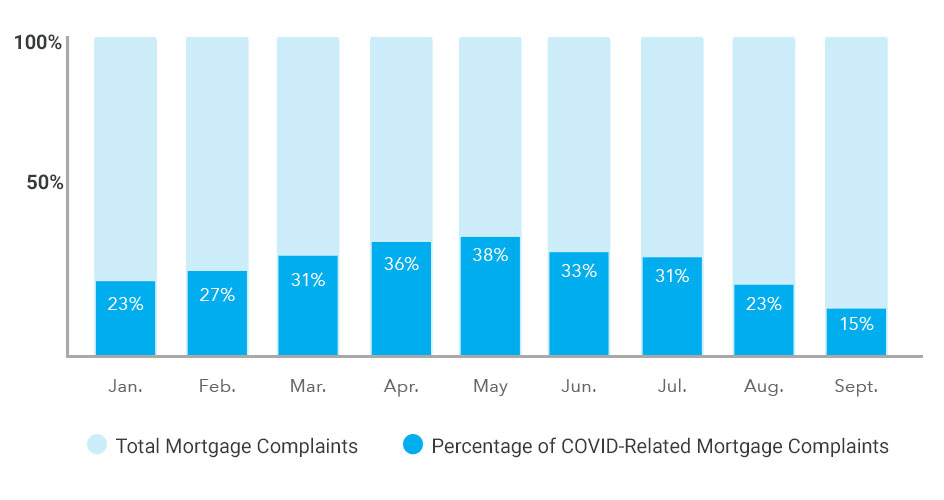

In May 2020, 38% of all mortgage complaints submitted to the CFPB were COVID-19 related.

To get a better understanding, we took a look at aggregate data from the PerformLine platform to see how call volumes correlated with complaint counts during those months.

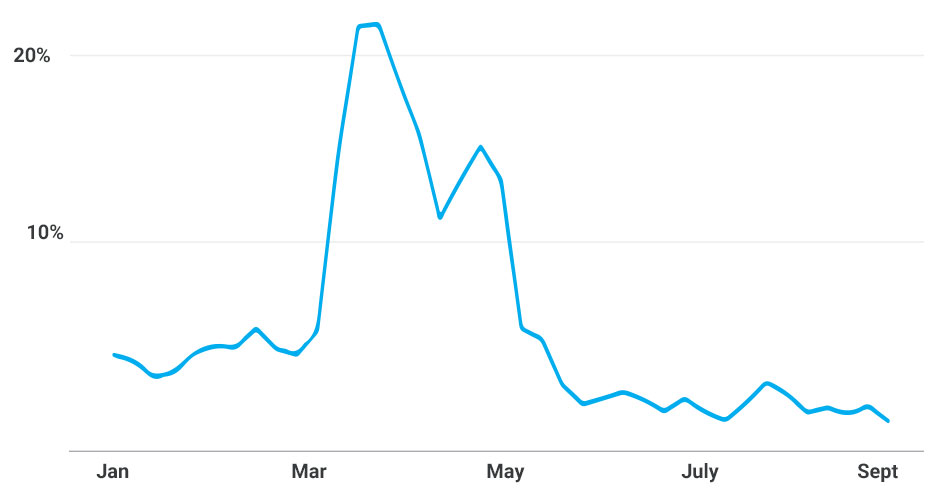

The graph below shows the percentage of calls made to mortgage companies that were qualified as verbal loss mitigation applications under Regulation X.

PERCENTAGE OF CALLS QUALIFIED AS VERBAL LOSS MITIGATION APPLICATIONS

Call volume peaked around March and April, but complaints to the CFPB peaked in May. Coincidence? Most likely not. It seems that many consumers may have tried to get in touch with their mortgage servicers, but had little success due to their high call volumes in their call centers, prompting them to submit their complaints to regulators for help.

What This Means for Mortgage Servicers

As COVID cases are starting to increase again and financial institutions are starting to see an increase in COVID-related calls (check out this blog for more insights), will mortgage servicers start experiencing another influx of calls for mortgage forbearance? While we can’t say for sure, it’s better to prepare for the possibility than to not.

The CFPB has made it clear that they will be placing high priority on industries with special provisions under the CARES Act-like mortgages-to guide their supervisory and enforcement efforts going forward. And, with Biden as the president-elect, mortgage companies must be prepared for increased regulatory scrutiny, especially since COVID-19 is #1 on the administration’s priorities.

Speak to one of our experts today to learn how PerformLine can help your organization manage high call volumes and expedite verbal loss mitigation applications, protect consumers, and get out ahead of compliance risks.