5 Common UDAAP Compliance Violations & How to Stop Them

As regulatory scrutiny for Unfair, Deceptive, and Abusive Acts or Practices (UDAAP) continues to grow, ensuring UDAAP Compliance is more important than ever.

In this post, we highlight five common UDAAP violation examples—exaggerated claims, subjective language, no barrier to entry, false sense of urgency, and credit deception—and offer practical ways to reduce risk.

Understanding these UDAAP red flags helps create marketing materials that are transparent and accurate, protecting both your consumers and your brand.

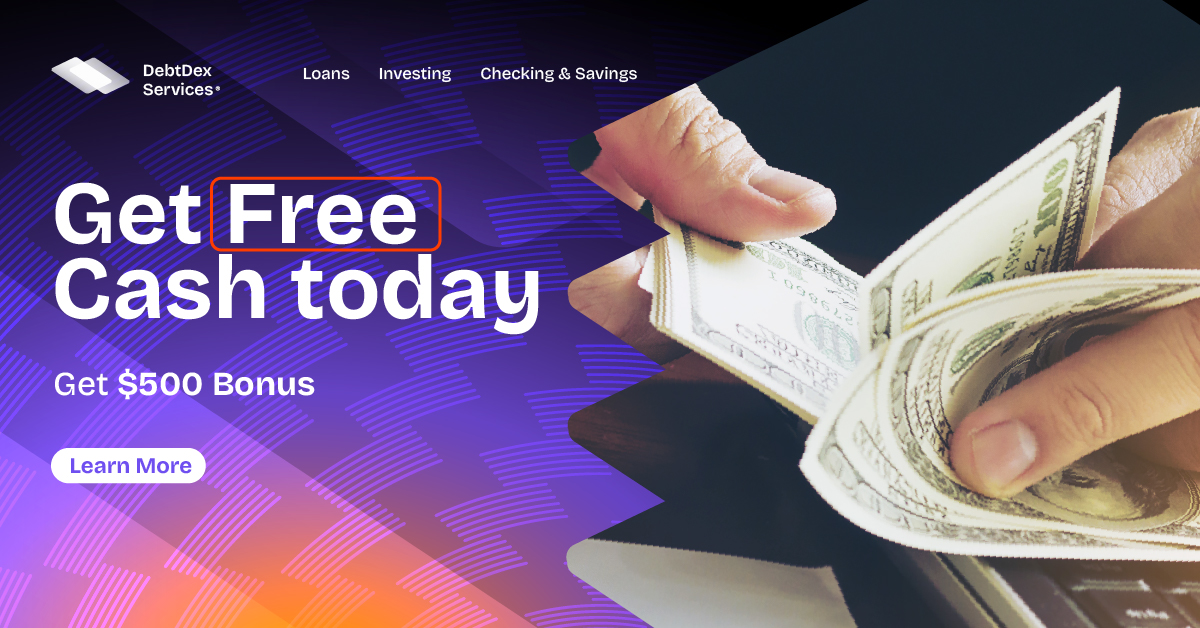

Exaggerated Claims

What are exaggerated claims?

Exaggerated claims are marketing statements that stretch the truth, making products appear more valuable or risk-free than they really are.

Example of an exaggerated claim:

A website promotes a “free” cash offer but requires consumers to sign up for a paid monitoring service. Because this cost is not disclosed clearly, the claim can be considered deceptive.

Why exaggerated claims are considered UDAAP violations:

Such claims raise UDAAP risks because they mislead consumers with unrealistic expectations. Marketing must clearly disclose fees, terms, and conditions so consumers make informed choices.

Subjective Language

What is subjective language?

This includes vague terms like “the best” or “number one,” which are open to interpretation and not supported by evidence.

Example of subjective language:

A credit card is advertised as “the best” without substantiation. What’s best for one consumer may not be best for another, creating UDAAP compliance concerns.

Why subjective language is considered a UDAAP violation:

Subjective statements can pressure consumers into decisions without objective information. Regulators view them as UDAAP violations when no disclaimers or supporting data are provided.

No Barrier to Entry

What is no barrier to entry?

Claims like “everyone qualifies” or “instant approval” imply that products are available without restrictions.

Example of no barrier to entry:

A flyer promises instant approval for a loan, but actual approval depends on credit checks that take days.

Why no barrier to entry is considered a UDAAP violation:

Such claims create false expectations and are especially abusive if they target vulnerable consumers. Transparency about eligibility requirements is essential to avoid UDAAP violations.

False sense of urgency

What is false sense of urgency?

Language that pressures consumers to act quickly when there is no true urgency.

Example of false sense of urgency:

A credit card promotion offers an immediate $100 bonus for signing up, encouraging fast action without considering long-term costs.

Why a false sense of urgency is considered a UDAAP violation:

False urgency manipulates consumer decision-making and can lead to UDAAP violation examples where consumers sign up under pressure instead of informed choice.

Credit deception

What is credit deception?

Any suggestion that a product will quickly fix or improve a consumer’s credit, when in reality approval or credit repair takes more effort.

Example of credit deception:

A landing page promises an easy loan to “fix bad credit.” In truth, loans are still subject to approval, and consumers could be misled into believing credit improvement is guaranteed.

Why credit deception is considered a UDAAP violation:

This type of UDAAP violation misrepresents the product’s ability to change credit status, leading consumers into risky or unaffordable commitments.

How to avoid common UDAAP compliance violations

To reduce UDAAP risks, a few steps that you can take to avoid common violations in your marketing materials include:

- Build clear policies for marketing reviews.

- Ensure material limitations and conditions are prominently disclosed.

- Substantiate claims with accurate data.

- Monitor consumer complaints to detect UDAAP red flags.

- Train employees on UDAAP/UDAP differences and enforcement standards.

Remember: UDAAPs can occur at any stage—product design, marketing, onboarding, servicing, or collections.

Bonus content: Get the free UDAAP compliance checklist

FAQs About UDAAP Violations

UDAAP is the acronym for Unfair, Deceptive, or Abusive Acts or Practices under the Dodd-Frank Act.

A UDAAP violation happens when a financial institution engages in unfair, deceptive, or abusive acts that cause consumer harm.

Examples include misleading cost claims, buried disclosures, balloon payments not explained clearly, and aggressive collection practices.

High reliance on penalty fees, vague marketing, “instant approval” language, or targeting financially vulnerable consumers all increase risk.

Products with complex pricing, frequent repricing, or unclear disclosures fall under higher UDAAP risk categories.

- UDAP: Unfair or Deceptive Acts or Practices (FTC Act).

- UDAAP: Adds “Abusive” under the Dodd-Frank Act.

Mitigate UDAAP Risk with PerformLine

PerformLine provides an omni-channel compliance solution across web, calls, email, messages, documents, and social media. With UDAAP rulebooks and monitoring tools, we help institutions detect violations early and remediate risks.

Ready to reduce UDAAP concerns? Schedule a demo and see how PerformLine can help.