Omni-Channel Compliance

Powerful Alone. Invincible Together.

Simplify Your Tech Stack With One Platform

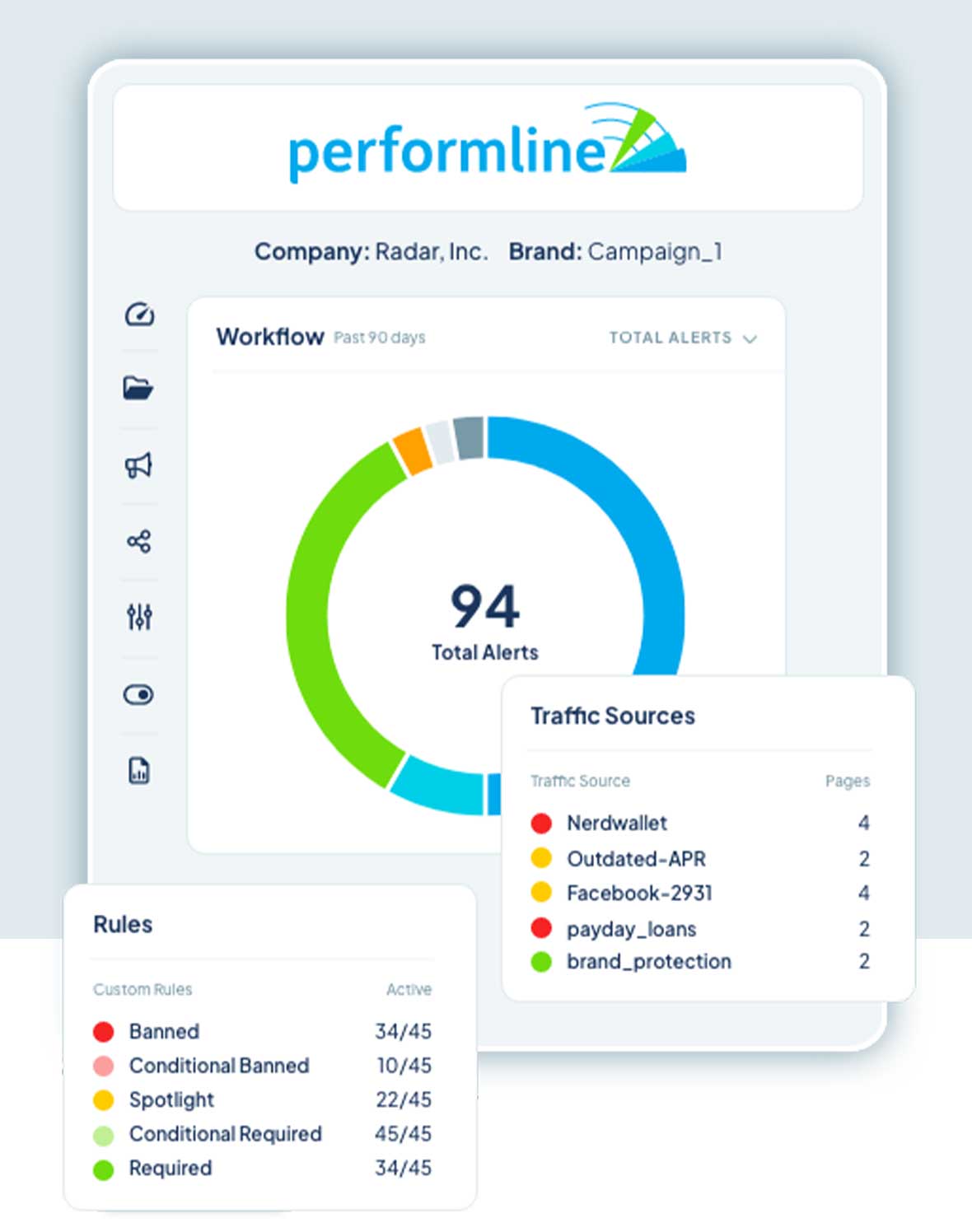

PerformLine ensures regulatory and brand compliance across marketing, partner programs, and loan officer content with AI-powered discovery and monitoring to find and mitigate marketing risk, efficiently.

Omni-Channel Compliance

Simplify Your Tech Stack With One Platform

Find the vanity URLs, emails, and social media posts made by loan officers to ensure compliant promotion.

Public use information obtained from NMLS® Consumer AccessSM for fast and easy onboarding and continually updated Loan Officer review.

Onboard more loan officers and increase new product GTM speed using compliance tech that scales internally and across marketing channels.

Demonstrate a commitment to marketing compliance and consumer protection with always-on discovery and monitoring.

Maximize time and cost savings by consolidating compliance efforts into one comprehensive platform.

Demonstrate to regulators that you’re taking the necessary steps to ensure compliance with a complete history of discovery through remediation for any audit situation.

How does Benchmark Mortgage approves content 6x faster with PerformLine?

PerformLine enables mortgage compliance teams to identify and address compliance risk through our end-to-end solution, from marketing material review to remediation across channels.

PerformLine replaces the need for multiple, disconnected solutions and provides a centralized, omni-channel marketing compliance management process for oversight. Experience total efficiency with PerformLine’s AI-powered platform.

“Compared to reviewing an item manually, items that are compliant get an approval response in less than five minutes with no human intervention required. This means that compliant pieces that are submitted take no human hours to approve—massive cost savings on time and effort.”

Jason Haeger

Digital Marketing Manager, Benchmark Mortgage

Additional Content

Mortgage companies can use PerformLine’s omni-channel compliance platform to automate and scale marketing compliance reviews and monitoring of their loan officers. PerformLine’s AI-powered platform provides proactive and comprehensive oversight across marketing and customer interaction channels.

Mortgage companies should use PerformLine to monitor loan officers across social media platforms, including Instagram, Facebook, LinkedIn, YouTube, TikTok, etc, and vanity URLs across the web. Mortgage companies can also use PerformLine to automatically review all marketing collateral from loan officers and partners for compliance prior to publication.

Mortgage companies should use PerformLine to monitor for regulations like the Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), Home Mortgage Disclosure Act (HMDA), Fair Housing Act (FHA), Equal Credit Opportunity Act (ECOA), Unfair, Deceptive or Abusive Acts or Practices (UDAAP), and other consumer protection laws.

Yes, PerformLine’s marketing compliance monitoring solution is designed to adapt to changes in mortgage regulations and industry standards, as well as emerging social media platforms and trends.

Yes, PerformLine can discover unknown or unapproved loan officer vanity URLs across the web and in email communications.

Using proprietary tools and sophisticated AI, PerformLine can discover previously unknown webpages, landing pages, offers, or emails that loan officers are promoting to consumers that you may not know about. PerformLine then monitors and scores those webpages, emails, or social posts against your rules to identify and alert you to non-compliant promotion.

PerformLine’s Business Intelligence provides detailed reporting and analytics for mortgage companies, including industry benchmarking data, loan officer compliance performance, trends over time, workflow activity, and more.