Choosing the Right Marketing Compliance Software

With the sheer variety of channels, products, and partners in play, financial institutions need a marketing compliance solution that offers more than just basic monitoring.

The solution should offer robust technology, proven experience and credibility, dedicated support, and the resources needed for continued success.

Here are some key features you should consider when choosing a marketing compliance software—and why PerformLine is the preferred solution for leading consumer finance companies.

Comprehensive coverage across marketing channels, products, and partners

Your organization uses more than one marketing channel to reach consumers, so why settle for compliance software that only handles one or two of them?

PerformLine offers end-to-end compliance reviews and continuous monitoring across multiple marketing channels, including:

- Marketing documents

- Web pages

- Social media

- Emails

- Calls

- Messages

Instead of having multiple disconnected solutions, PerformLine delivers a holistic view of your compliance efforts within a single platform, allowing you to manage your marketing materials efficiently and effectively.

PerformLine doesn’t just offer coverage across marketing channels—we also provide comprehensive oversight of your different products, lines of business, and partners, too.

Whether you’re struggling to manage a high volume of marketing materials, multiple products with different regulatory compliance requirements, or a big network of partners and third parties (or any combination of these), PerformLine has you covered.

PerformLine’s partnership has allowed us to automate manual web monitoring efforts and provide scalability to increase coverage across thousands of web and social media sites.

Bread Financial

Discovery of unknown brand mentions

It’s not enough to have oversight of known marketing assets for your brand. What about the potentially hundreds or thousands of places that mention your brand or products that you don’t know about that have compliance issues?

PerformLine offers unmatched discovery capabilities across the web, social media, and emails.

Our proprietary discovery tool automatically uncovers the unknown, finding previously undetected places where your brand appears. Once these placements are found, they’re then scored against your compliance rules and are only flagged for review if any potential compliance issues are identified. This saves you from manual searches and provides continuous oversight and monitoring.

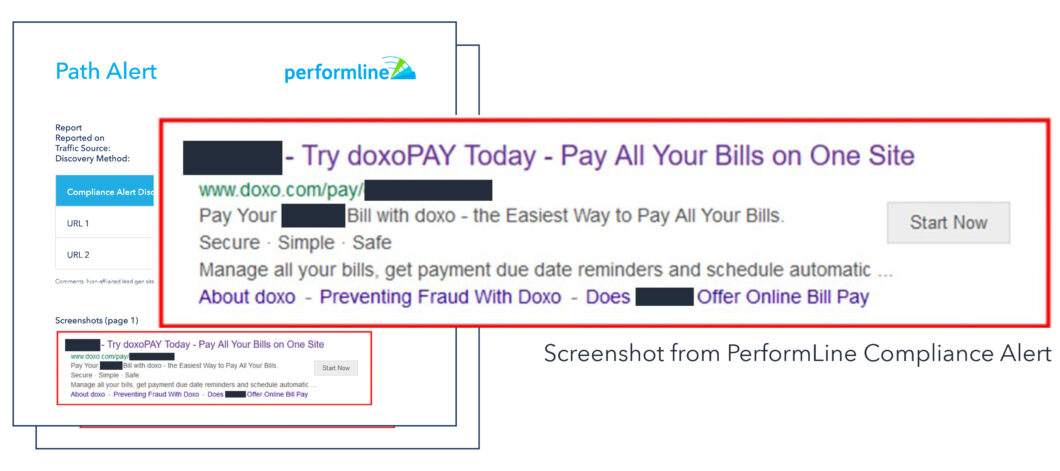

For example, the FTC took action against a bill payment company for using brand names and logos to deceive consumers.

Our discovery ability successfully identified deceptive search ads from this bill payment company using clients’ brand names, allowing these clients to take quick corrective action. Without PerformLine, they likely wouldn’t have found these ads.

Our discovery capabilities have also significantly increased our clients’ scope of oversight, some seeing up to 138x more compliance coverage of their brand.

Extensive experience in the marketing compliance space

Experience matters when it comes to compliance management, so it’s important to choose a provider with a proven track record and deep industry knowledge.

As a pioneer in the marketing compliance space, PerformLine deeply understands the challenges that financial institutions face and provides solutions built to meet the rigorous demands of regulated industries.

Since 2007, PerformLine has led the way in marketing compliance technology, partnering with major players across banking, mortgage, buy now pay later (BNPL), fintech, credit cards, and more.

Our platform goes beyond software—it’s a comprehensive, scalable solution designed to grow with your business as you expand into new markets. With PerformLine, you gain more than just tools; you gain a partner with industry expertise and a steadfast commitment to supporting your success.

Everyone at PerformLine who I have worked with has been an amazing partner. They have all been supportive, patient, knowledgeable, and I genuinely enjoy talking to them!

Mercury

Dedicated Client Success Manager for personalized support

Your provider should come with someone who will work alongside you to ensure you’re getting the most out of your software, optimizing it to meet your unique compliance needs and goals.

At PerformLine, every client is partnered with a dedicated Client Success Manager (CSM) who acts as your primary point of contact.

Your CSM collaborates with you to provide tailored guidance, address any questions, and share strategic insights on maximizing the platform’s capabilities.

From assisting in the set up of custom rules to analyzing data insights, your CSM is there to ensure you’re gaining full value from the platform and that it’s aligned with your needs.

Ability to scale and grow alongside the business

Implementing and onboarding a new technology takes time and effort, so choosing a solution that can grow, scale, and adapt alongside the business is invaluable—and that’s what PerformLine is designed to do.

As your organization grows—whether by entering new marketing channels, expanding product lines, or moving into new markets—PerformLine’s platform can easily adapt to new or growing compliance needs.

Unlike smaller, less flexible solutions that only provide temporary fixes, PerformLine offers the solid support and resources needed for businesses dealing with more complicated regulations or increased regulatory oversight.

This saves a significant amount of time, resources, and money in the long run that would otherwise be spent vetting, onboarding, and learning a new platform.

And, our platform is always evolving based on the needs of our clients and the demands of the regulatory environment.

Some of our most popular products have come directly from client feedback, like our Document Review solution and the addition of TikTok under our Social Media Monitoring solution.

With PerformLine, you’re not just investing in a compliance solution—you’re securing a partner committed to evolving with your business, meeting regulatory demands, and empowering your growth for the long term.

Enterprise-grade software with robust policies and procedures

When it comes to your marketing compliance provider, a foundation of trust and proven reliability is essential.

PerformLine is a trusted enterprise-grade partner with a proven track record.

We’ve worked with some of the biggest names in finance and banking, ensuring that our software includes robust third-party risk controls.

Our software is procurement-approved at some of the largest financial institutions in the U.S., which means it meets the strict standards required for security and reliability.

We have gone through thorough vetting by information security teams, ensuring that your data is well-protected. PerformLine also includes a robust disaster recovery plan to safeguard your operations in case of unexpected events.

Streamlined, customizable rulebooks and rule management

Your marketing compliance software should make it easy to manage rules and alerts without becoming overwhelming.

We know that too many rules at once can create overwhelming noise, making it hard to find what truly matters. That’s why PerformLine’s platform is built to cut through the clutter with a streamlined rule management approach that keeps your focus on the most relevant alerts.

Understanding that context is key, so our platform offers context-aware exceptions to deliver more accurate, fine-tuned compliance coverage. With options like banned, required, conditionally banned, and conditionally required logic, you can customize compliance oversight to your specific needs.

Rather than casting a wide net and drowning in alerts, PerformLine narrows the focus, ensuring you’re only notified of issues that truly impact your business.

Our platform also offers weighted rules, allowing you to prioritize certain compliance concerns over others. This targeted approach simplifies compliance management, minimizes noise, and keeps your team focused on the most pressing matters without unnecessary distractions.

PerformLine’s expertly crafted rulebooks, combined with custom rules tailored to each organization’s unique needs, make our platform one of the most robust solutions available—and why leading organizations rely on it.

And you’re not on your own—our dedicated Client Success Managers work with each client to help customize, optimize, and evolve rules, offering ongoing recommendations to keep pace with your business.

Leveraging [PerformLine] technology to ingest rules that trigger on an alert, being able to triage them on a risk-adjusted basis, and then filter them into workflows is the only way we can do this at scale. It’s not something that we can handle in spreadsheets on a manual basis. It has to be something that’s built into our platform and systems that we’re able to do with the right number of full-time employees and not an army of compliance people like traditional financial institutions sometimes do.

Stripe

Real ROI and time savings

The ultimate goal of any software is to deliver measurable returns on investment and significant time savings.

By automating the monitoring of marketing content, our platform frees up thousands of hours for your team, allowing them to focus on strategic initiatives rather than tedious, manual compliance checks.

The efficiency and oversight gained through PerformLine translate into real business benefits.

Here are some ways we’ve helped clients find success and achieve real ROI and time savings:

- 1,200 hours saved per month vs. manual review

- 60x increase in brand oversight

- 90% faster compliance review and approvals

[PerformLine] saves me and my team a tremendous amount of time and makes us more efficient.

Central Payments

Industry involvement and community resources

Look for a solution that not only provides robust technology but also delivers deep industry insights, ongoing education, and a supportive community.

Our expertise extends well beyond delivering a powerful marketing compliance platform. We’re committed to arming our clients with the latest insights and proprietary data, empowering them to stay ahead in an ever-evolving compliance landscape.

With access to exclusive insights and thought leadership available only through PerformLine, our clients are equipped to make strategic, informed decisions that refine their compliance approach.

To make these insights actionable, PerformLine hosts a series of events focused on sharing industry trends and creating a vibrant community of peer connections.

From Tuesday Tutorials and annual Client Workshops to webinars and in-person events, we bring together industry leaders to discuss the regulatory landscape and share emerging best practices.

These sessions provide clients with the tools they need to tackle today’s compliance demands and stay prepared for tomorrow’s challenges.

I also make time each week to listen to PerformLine’s COMPLY podcast and read the Regulatory Roundup. I also look forward to the COMPLY Summit events. When I have a specific regulatory question, my first stop is the Resource Library. Most of the time, I can find the answer there, which saves me a lot of time.

RXMG

Is PerformLine Right for Your Organization?

While PerformLine offers powerful tools for marketing compliance, we recognize that our platform isn’t for everyone.

PerformLine is an ideal fit for companies that have reached a certain level of regulatory and operational maturity and are looking for a comprehensive solution to scale their compliance efforts efficiently.

PerformLine is a good fit if your organization:

- Is regularly audited: PerformLine simplifies compliance monitoring, ensuring you stay audit-ready and compliant with federal regulations.

- Has over $10 billion in assets or is nearing that threshold, making you subject to CFPB oversight: PerformLine is designed to meet the complex demands of highly regulated industries, helping you manage CFPB compliance efficiently.

- Is fast-growing with hundreds of partners, or plans to onboard a large number of new partners quickly: PerformLine’s scalable platform supports rapid growth, streamlining compliance processes as your business expands.

- Has established internal regulatory rules and brand guidelines: PerformLine’s customizable rulebooks complement your existing framework, adapting to your unique compliance needs and risk thresholds.

- Involves a team of stakeholders: Successful integrations typically require a team of internal stakeholders, ensuring PerformLine is effectively embedded into your company’s compliance strategy.

Get Started with PerformLine

When choosing your marketing compliance software, you want to make sure you’re choosing the best fit to support and grow alongside your business.

PerformLine offers a proven track record, a customizable platform, and unmatched client support, making it the ideal choice for companies looking to scale while staying compliant.

With flexible pricing, dedicated support, and continuous learning opportunities, PerformLine is more than just software—we’re a true partner in your compliance journey.