Here’s Where Marketing Compliance Risk Hides (and How to Find It)

Marketing compliance risk isn’t rare, and it isn’t random. But it can be hard to find manually.

That’s one of the clearest takeaways from PerformLine’s latest benchmark report of marketing compliance risk for leading U.S. banks.

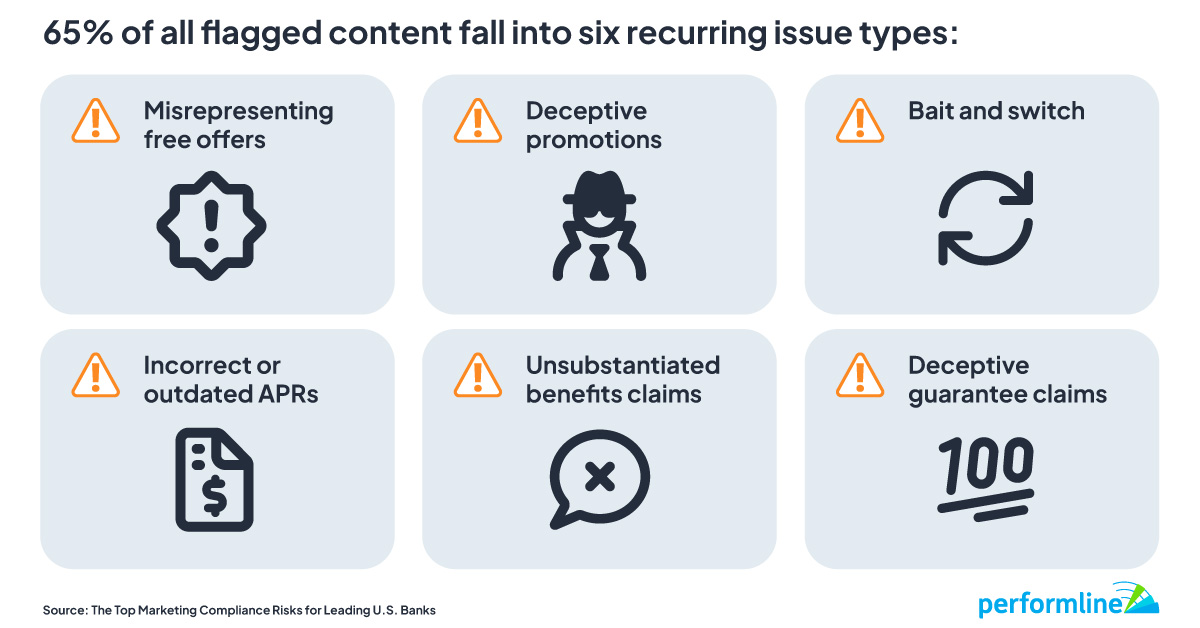

We analyzed thousands of web pages tied to bank brands and products and found that 65% of all flagged content was concentrated into just six issue categories.

And in this benchmark, most of those issues lived outside of owned and operated channels.

The highest-risk content wasn’t sitting on bank-owned websites. It was appearing across affiliate pages, publisher articles, comparison sites, and other third-party placements.

The false sense of security banks rely on

Most large banks invest heavily in pre-publication reviews, legal approvals, and internal sign-off processes.

While that’s an important part of the process, it doesn’t cover risk after the fact.

Once marketing content goes live, it doesn’t stay put. It gets republished, summarized, quoted, copied, and modified across affiliate and partner sites, comparison and review pages, publisher content and SEO-driven articles, and other third-party placements outside your direct control.

Those pages change frequently, age quietly, and are rarely part of routine audits.

Pre-publication review controls what you launch. It doesn’t control how that content spreads.

That’s where marketing compliance risk builds—not because teams aren’t careful, but because visibility drops off after launch.

Where marketing compliance risk actually hides

Across the benchmark, a majority of flagged issues were found on non-owned web pages.

These placements share a few traits:

- They’re difficult to uncover with manual searches

- They persist long after campaigns change

- They often reflect outdated terms, rates, or conditions

- They still carry your bank’s brand in the consumer’s mind

They may not be under your operational control, but they still shape consumer perception and regulatory exposure.

By the time they surface—through a complaint, internal escalation, or regulatory review—they’ve often been live for months.

How often marketing content creates compliance risk

On average, 8% of pages discovered by PerformLine present potential marketing compliance issues.

That number comes from using Kraken, our proprietary discovery technology, to identify where bank brands and products are being promoted across the web—including pages that are difficult or impractical to find through manual searches or routine audits.

Once discovered, we then evaluate that content against our compliance rulebooks, which map specific terms, phrases, and patterns to defined risk categories.

8% sounds manageable until you apply it to scale.

For example, if your brand or products appear on 1,500 web pages, that means an estimated 120 of those pages may contain issues that need attention.

The biggest challenge with this is:

- How are you finding those pages?

- How quickly can you prioritize what matters most?

- How are fixes tracked, escalated, and documented for audits?

Manual approaches struggle here—not because your teams aren’t capable, but because volume and change simply outpace human review.

Manual search lacks systematic discovery. It doesn’t continuously rescan. It doesn’t centralize documentation. And it doesn’t scale across thousands of evolving third-party placements.

The six risk categories that show up again and again

While marketing compliance risk is widespread, it’s also predictable. In this benchmark, 65% of all flagged content fell into six recurring issue types:

- Misrepresenting free offers

- Deceptive promotions

- Bait and switch

- Incorrect or outdated APRs

- Unsubstantiated benefits claims

- Deceptive guarantee claims

These issue types show up consistently across the industry. And once content spreads across third-party sites, even small wording issues can turn into repeated exposures across dozens or hundreds of pages.

They also align closely with patterns seen in enforcement actions related to deceptive marketing, inaccurate disclosures, and third-party oversight failures.

The full benchmark breaks down each category with real, anonymized examples.

Why scalable discovery and monitoring close the gap

Traditional compliance tools weren’t built for today’s marketing environment. Sampling, periodic audits, and ad hoc searches can’t keep pace with:

- Thousands of live web pages

- Frequent content changes

- Rate updates and regulatory shifts

- Third-party publishing you don’t control

Scalable discovery and continuous monitoring change the equation. Instead of guessing where risk might exist, you gain ongoing visibility into where your brand shows up and what’s being said.

That visibility makes it possible to:

- Catch issues earlier

- Focus effort where risk is most concentrated

- Reduce remediation time

- Maintain defensible documentation for audits and exams

Visibility is the control point

Marketing compliance risk doesn’t come from lack of effort, it comes from lack of visibility and coverage.

When risk lives beyond owned channels, confidence depends on discovery.

The question isn’t whether risk exists. It’s whether you can see it—before regulators, customers, or partners do.

See your marketing compliance risk beyond owned channels

Want to see where this risk shows up for your bank?

Request a free, personalized Marketing Compliance Risk Snapshot to see your own exposure across the web, reviewed live with PerformLine’s team.

Frequently Asked Questions

Marketing compliance risk pertains to the potential for non-compliance with regulations in marketing content, which is difficult to identify manually due to its widespread distribution across various third-party sites and the frequent changes these pages undergo after initial approval.

Most compliance risks are found on third-party sites such as affiliate pages and publisher articles because these are less controlled and more difficult to monitor than bank-owned websites, yet they still influence consumer perception and regulatory risk.

On average, about 8% of pages where a bank brand appears contain potential compliance issues, which can be a significant number when considering large-scale online presence.

The six major issues include misrepresenting free offers, deceptive promotions, bait and switch tactics, outdated or incorrect APRs, unsubstantiated benefit claims, and deceptive guarantee claims.

Scalable discovery and continuous monitoring provide ongoing visibility into where your brand appears and what content is being shared, enabling earlier issue detection, focused efforts on high-risk areas, faster remediation, and better preparation for audits.